Lower-Tier Hospitals Will See More Medical Device Growth In 2013: Citi Hospital Survey

This article was originally published in PharmAsia News

Executive Summary

Spending on new medical equipment by top-tier hospitals in China is expected to ease in 2013, but still show double-digit growth with multinationals like General Electric competing with domestic firms led by Mindray Medical.

SHANGHAI – The pace of growth in medical equipment spending will slow down in China’s larger hospitals this year as the government shifts its focus to encouraging patients to visit county-level hospitals to ease overcrowding at major complexes, according to a recent survey by Citi Investment Research.

Spending on patient monitors, color ultrasound devices, anesthesia machines, digital radiography and biochemistry analyzer devices will maintain double-digit growth levels at 10.8% in 2013, the investment bank predicted. Growth for that market in 2012 was roughly 11.6% and 12.6% from 2009-2011, according to the survey, which was sent to 13,000 hospitals across China’s 31 provinces.

More than 70% of the 420 respondents said their hospitals plan infrastructure upgrades through 2015 “implying that the construction cycle could remain a key driver for the Chinese medical device market over the next three years,” said Hong Kong-based Richard Yeh, head of China healthcare research for Citi Investment Research.

The report said in the case of color ultrasound machines, more than 90% of top-tier hospitals already have such equipment and demand would come instead from lower-tier hospitals. That change is driven by the continued government push for patients to seek treatment at local hospitals instead of crowding larger tier-3 hospitals in the major cities.

“Replacement could become a new driver to the market over the next three years, as we observed that patient monitors in over 45% of hospitals have been in service on average more than five years” – Citi survey

General Electric Co. and Royal Philips Electronics NV are two of the biggest players in the ultrasound space, controlling close to 50% of China’s market. Mindray Medical International Ltd., the leading domestic player, holds 6.3% of the market.

China’s medical device market is expected to be among the top three globally by 2020, analysts predict (Also see "China Device Market Looks Set To Gain In 2013 As Health Care Reforms Favor Diagnostics" - Scrip, 14 Feb, 2013.).

Domestic Companies Gain County Ground

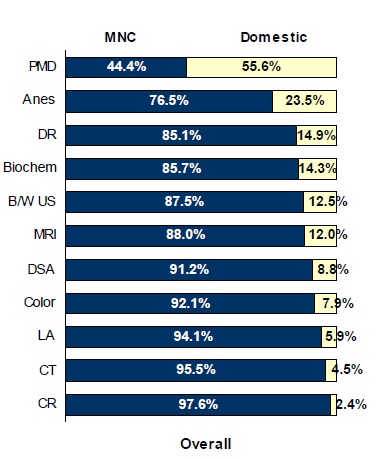

Demand for more sophisticated equipment like computed tomography, magnetic resonance imaging, digital subtraction angiography and medical linear accelerators, is still driven mainly by top-tier hospitals, the survey found, with multinationals controlling 85% of the market in 10 key device segments.

Market Share: MNCs Vs Domestic

Source: Citi Research (values on left: patient monitor devices, anesthesia, digital radiography, biochemical analyzer, black-white ultrasound, magnetic resonance imaging, digital subtraction angiography, color ultrasound, linear accelerator; computed tomography and computed radiography).

Domestic companies have gained market share in county-level hospitals, particularly in patient monitors, anesthesia devices, digital radiography devices and automatic biochemistry analyzers, the survey said.

“As we believe the market growth is shifting from high-end hospitals to county-level hospitals in 2013 and beyond, we expect faster ramp-up of domestic players in the medical device market over the next three years,” Yeh wrote, noting that patient monitors and color ultrasound devices will lead procurement efforts in that period. Roughly 80% of hospitals surveyed said they would purchase patient monitors priced below RMB 50,000.

Domestic device maker Mindray has a good chance to gain share in patient monitors at the county and top-tier level, the survey suggests, as Mindray has a solid product that will be attractive when it comes time to replace worn equipment.

“Replacement could become a new driver to the market over the next three years, as we observed that patient monitors in over 45% of hospitals have been in service on average more than five years, compared to the average service life of five to seven years for a patient monitor,” the survey said. The report noted that the average number of patient monitors per 100 hospital beds is 11.6 in China, much lower than the average of 40 in the United States.

Citi said Mindray was the top pick in the domestic market due to its well-established sales network and brand reputation in county-level hospitals. It also notes the company is ramping up in the in vitro diagnostics market.

“We believe that Mindray could deliver sustainable solid growth based on our forecast of '12-‘14E revenue and EPS CAGRs of 17% and 15%, respectively,” Yeh wrote in a Feb 27 research note. “Mindray offers, in our view, a more attractive risk/reward profile than its U.S. peers given the company's faster revenue and earnings growth, driven by 1) a solid share of the patient monitor market; 2) a fast ramp-up of the IVD business, and 3) growth opportunities at county-level hospitals.”

The survey said 65% of the hospitals responding preferred Mindray for new patient monitor purchase decisions.

Seeing the opportunity, Mindray is also increasing its bet through a combination of new product launches and sales force investments (Also see "China's Top Device Maker Mindray Enters Critical Care Market; Sees Boosts From Color Ultrasound Devices" - Scrip, 13 May, 2011.).

Black-and-white ultrasound devices are increasingly being installed in county-level hospitals compared to higher-tier hospitals, where they are being replaced by color ultrasound machines. Multinationals lead the black-and-white ultrasound market, with Hitachi-Aloka accounting for 25% of the market, followed by GE, Philips, [Siemens Corp.] and Toshiba Medical Systems Corp. Mindray is the second-largest black-and-white ultrasound manufacturer in the county-level market, the survey said.

Hospitals prefer global brands for the higher end color ultrasound equipment, according to Citi. GE/Philips and Siemens collectively holding about 60% of China’s color ultrasound market.

Still, the survey report said multinationals plan to also compete at county-level hospitals either through enhanced sales efforts or partnerships and M&A. Philips, for example, bought Shanghai Apex, an ultrasound transducer provider in China, to expand its low-end ultrasound product line (Also see "Philips Acquires Shanghai Apex, Targets Low-End Ultrasound Market In Wake Of China Healthcare Reform" - Scrip, 29 Jul, 2010.).