ASCO 2023 – Roche Sees Morpheus And Takes The Red Pill

Executive Summary

The company’s TIGIT data are strong enough for a phase 3 trial to be launched, ASCO learns.

Six Months On Gilead/Arcus’s TIGIT Deflates

The run-up to this year’s ASCO meeting saw a remarkable resurgence of interest in the TIGIT mechanism, but the 3 June update on Gilead/Arcus’s Arc-7 study in NSCLC could puncture the enthusiasm. With 7.4 months’ additional median follow-up, and six more patients in each cohort, the PFS data for domvanalimab plus zimberelimab have deteriorated versus zimberelimab monotherapy. The anti-Tigit/PD-1 doublet that at December’s ASCO virtual plenary had shown a 45% reduction in risk of progression or death, and a 6.6-month increase in median PFS versus the Arcus PD-1 alone, now stands at a 33% reduction and 3.9-month delta, the new ASCO update revealed. Not only that, but the confidence interval upper bound is now 1.13, having earlier stood precariously at 1.00 exactly. True, the shape of the PFS curves and small numbers of patients make it evident that just one or two early progressers might be making the difference. But the meaningfulness of Arc-7 was already in doubt, and the optics of a dataset that is clearly not improving will not go down well with fickle investors.

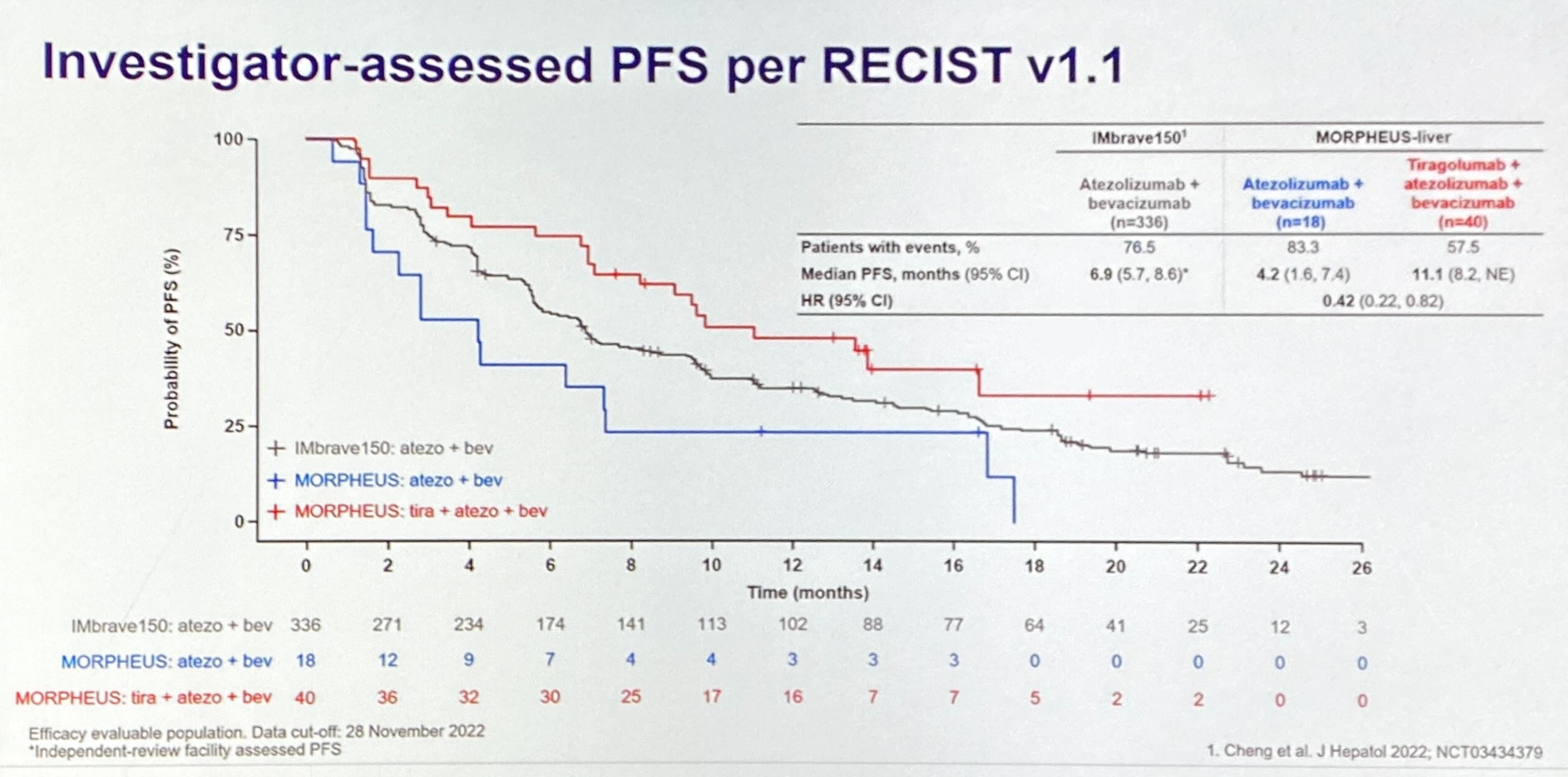

After Arcus/Gilead’s TIGIT data shocked at the start of the American Society of Clinical Oncology annual meeting, Roche brought another bombshell. Roche’s fact-finding mid-stage Morpheus-liver trial, which had sent Tigit-fixated investors’ pulses racing a week ago, has delivered a strong enough signal for a phase 3 trial to be launched, ASCO learned 4 June.

Presenting the Morpheus-liver data in full, UCLA’s Dr Richard Finn outlined a global, placebo-controlled study, Imbrave-152/Skyscraper-14, that would pit tiragolumab, Tecentriq plus Avastin versus a Tecentriq/Avastin doublet in the front-line setting. This, he told ASCO, would measure overall and investigator-assessed progression-free survival as co-primary endpoints, and was “expected to begin soon”.

His enthusiasm was backed not only by the topline PFS numbers generated by Morpheus-liver, but also by a retrospective analysis using “Bayesian dynamic borrowing” designed to generate possible “synthetic” control arms. The purpose of this was to counter one of the readout’s biggest criticisms, namely that Morpheus-liver’s actual control arm vastly underperformed the performance of Tecentriq plus Avastin in Roche’s Imbrave-150 trial, flattering the result.

The new analysis aimed to counteract imbalances in patients’ baseline criteria, and generated three possible more realistic controls, ranging from a conservative to a fully matched scenario. Each generated a positive reduction in risk of progression or death, from 28% to 51% with tiragolumab, Tecentriq plus Avastin, versus a Tecentriq/Avastin doublet. Meanwhile, Morpheus-liver showed a 58% reduction.

Source: Dr Richard Finn & Asco.

Still, it is not entirely clear why the mid-stage trial’s actual control cohort underperformed. The ASCO presentation revealed patients’ baseline imbalances, some of which favoured active treatment, though others, including disease severity, favoured control. Moreover, Morpheus-liver overall contained a lower percentage of hepatitis B patients than Imbrave-150.

All these considerations aside, Finn said the fundamental confounding issue might have been Morpheus-liver’s relatively small size. The study discussant, Memorial Sloan Kettering’s Dr Ghassan Abou-Alfa, said that while Bayesian modelling was intriguing Morpheus-liver should simply be celebrated for delivering a positive result that now needed corroborating in a larger trial.

Investors in other TIGIT companies – not least Arcus – might be celebrating tomorrow, too.

Source: Dr Richard Finn & Asco.

– Jacob Plieth ([email protected])

This article originally appeared in Evaluate Vantage. Evaluate Vantage and Scrip are part of the same parent company, Norstella.