Cash Runways Dry Up, Creating A ‘Complex’ Road Ahead For Biotech

EY Beyond Borders Report Highlights Cash Drought

Executive Summary

More than half of emerging biotech companies have less than two years of cash to fund operations, according to EY’s Beyond Borders report.

The biotech financing environment appears poised to remain a top concern for young start-up companies, which are having to make difficult decisions about capital allocation. The number of biotechs that are down to one or two years of cash is eye-catching, according to a new report from the consulting firm EY covering the state of the biotech industry.

Key Takeaways

- More than half of emerging biotechs do not have enough cash to sustain operations for two years.

- M&A could return investors to biotech and big pharma has unprecedented firepower for deals.

- Yet, FTC’s recent scrutiny has created uncertainty that could defer deals.

- Biotech sector more broadly remains on solid financial footing, which should reassure investors.

EY’s Beyond Borders report was released on 6 June, coinciding with the BIO International Convention in Boston on 5-8 June, spotlighting what the firm called a “complex” path forward for many biotech companies.

Among emerging biotechs (companies with less than $500m in annual revenue), 55% do not have sufficient cash to fund operations for the next two years and 29% have less than one year’s cash remaining, according to the report. The number is higher than it was in 2021, when only 18% of biotechs had less than a year’s cash in reserve, and puts mounting pressure on management teams to prioritize spending decisions.

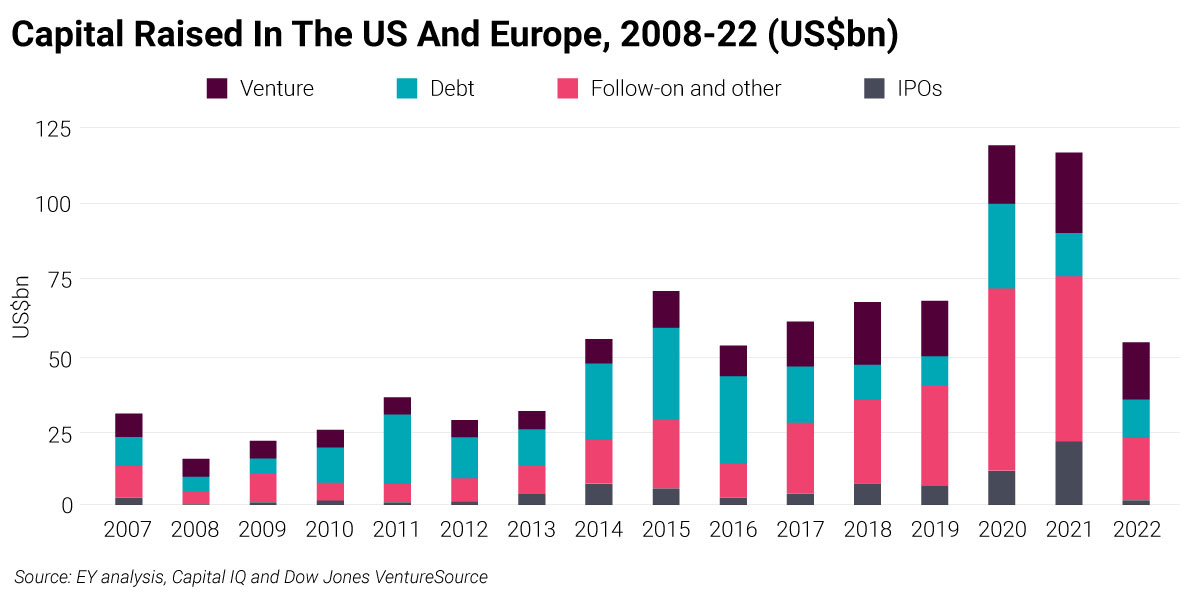

Of 223 companies that went public in 2020 and 2021 and were still publicly traded at the end of 2022, 91% of them saw their market value at the time of their initial public offering drop with an average decline of more than 50%. The coinciding drop in follow-on funding has created an ominous situation for the long-term prospects of many newly launched companies, EY said.

“That kind of puts the capital allocation at the front and center,” EY Americas industry markets leader Arda Ural said during a media roundtable, discussing the report. Biotechs need to think about outsourcing to preserve cash or hiring part-time employees in place of full-time, and make investment decisions quickly, he added.

At the same time, he said the biotech industry is a bit like the best of times/worst of times in A Tale of Two Cities, because other biotechs that were able to successfully launch an IPO or raise cash when the financing environment was strong two or three years ago and have made it through certain inflection points are in a better position to continue to raise capital. That is a sentiment many experts in the biotech space have been repeating since last year, that financing still exists for certain companies with the right science and the right management teams. (Also see "Financing Available For Some, But Not All Biopharma Companies In 2023" - Scrip, 18 Jan, 2023.)

“It’s a mix of good news and bad news,” Ural said. “We remain optimistic about the future.”

That said, more biotechs are likely to be forced to shut down operations before the financing environment improves dramatically, EY US biotech leader Richard Ramko predicted.

“There needs to be a bit of, should we say, cleansing of the system and get back to more of a normal level of capital raising,” Ramko said. “It may take 12-18 months to get there.” Not every company will survive waiting for the cash drought to end, however, he said.

There may be some early signs of improvement. For example, a handful of IPOs have been completed this year, including two that were well received by investors in May. (Also see "Finance Watch: Kenvue, Acelyrin Launch Biggest Biopharma IPOs Of 2023" - Scrip, 5 May, 2023.)

“I think we need to see more good clinical data from companies, and then I think we need to see some M&A,” Ramko said. “At the end of the day, investors need to make money on biotech, and then we will start to see more of a flow of capital back into the space.” IPOs along with mergers and acquisitions are the two primary exits for biotech investors.

FTC Uncertainty Raises M&A Stakes

Pharma M&A had appeared on the cusp of a boom a few months ago, with two big deal announcements in particular igniting investor excitement: Amgen, Inc.’s $28bn acquisition of Horizon Therapeutics plc, announced in December, and Pfizer Inc.’s $43bn acquisition of Seagen Inc. , announced in March. (Also see "Pfizer Pays $43bn For Seagen With Goal Of Rapidly, Globally Advancing ADCs" - Scrip, 13 Mar, 2023.) But the narrative took a turn in May when the US Federal Trade Commission (FTC) announced an attempt to block the Amgen/Horizon deal, citing Amgen’s rebating tactics and raising questions about how the regulator is viewing other large pharmaceutical acquisitions. (Also see "FTC’s Challenge Of Amgen/Horizon Merger Seeks To Fight Pharma Rebating Practices" - Scrip, 16 May, 2023.)

The uncertainty in the regulatory environment could put a pause on additional large transactions until the industry has more clarity on the situation.

At the same time, large pharmaceutical companies have plenty of money to invest in M&A, and those companies need new and future growth drivers to offset big losses from patent expirations and other pressures coming later in this decade.

Large pharma manufacturers have an unprecedented amount of firepower to do deals, approximately $1.4 trillion in cash that could be used for M&A as of the end of 2022, according to EY. Nonetheless, industry has remained cautious on deals, while searching for strong strategic fits, even as many have predicted an uptick in M&A should be coming. (Also see "Are Market Conditions Setting Up A Biopharma M&A Wave?" - Scrip, 23 Jun, 2022.)

“Even though the larger pharma companies have a significant amount of firepower, they are still going to be very diligent about what they are purchasing,” Ramko said. “They’re not purchasing something just because it’s cheap. They’re purchasing something because it is good, because it adds to the portfolio.”

The action now by the FTC adds to the uncertainty, particularly because the regulator is taking issue with a different competitive tactic – rebating – than it has historically. In the past, the FTC has generally focused on commercial portfolio and even R&D pipeline overlap when it comes to determining whether or not a transaction is anti-competitive.

The FTC’s move on Amgen/Horizon may have deferred some other dealmaking that was under way, Ural speculated.

“We will never know which board meeting is deferring a deal based on the news flow. That’s a privileged small community of people who are voting on a merger or acquisition.” But, he said, the action has created uncertainty, which historically presents challenges to dealmaking.

“The regulators need to provide a predictable business operating environment for the companies to deploy [their] capital,” he said. “The pharma companies need to know they’re playing chess, checkers or basketball. If they can’t then they will be hesitant to deploy capital, and these are massive capitals we are talking about.”

A COVID Recovery Headwind

Despite the cash constrained environment for young biotechs, the biotech sector more generally remains on solid financial footing, though it is facing challenging growth comparisons coming out of the COVID-19 pandemic.

Public biotech companies in the US and Europe collectively generated $215bn in revenues in 2022. Those revenues were down 1% over 2021, but the decline was driven almost entirely by lower sales of COVID-19 vaccines and treatments at companies like BioNTech SE, Gilead Sciences, Inc. and Regeneron Pharmaceuticals, Inc..

Outside of the short-term impact from pandemic-related products, the industry maintained a stable growth trajectory, EY said. Excluding the revenue impact of COVID-19 products in the portfolios of five leading biotechs, the industry’s revenues increased 3.7% in 2022, compared with 5.2% growth in 2021.

EY pointed to the stable growth as reassurance for biotechs and investors that the industry is well positioned to weather the current challenges.

EY