ASCO 2023 – Deep And Early Responses Lift Hopes At Effector

Executive Summary

New data with a novel RNA translation regulator gave the stock a pre-ASCO boost, but the micro-cap company needs to keep the momentum going.

Encouraging safety and efficacy data with zotatifin prompted eFFECTOR Therapeutics, Inc. to reinstate dose escalation last year, and the latest cut of data from an ongoing phase 1/2 trial was presented at the American Society of Clinical Oncology annual meeting on 4 June. The agent, said to work by inhibiting specific mRNAs involved in tumour growth, is being tested in a highly refractory ER-positive metastatic breast cancer population.

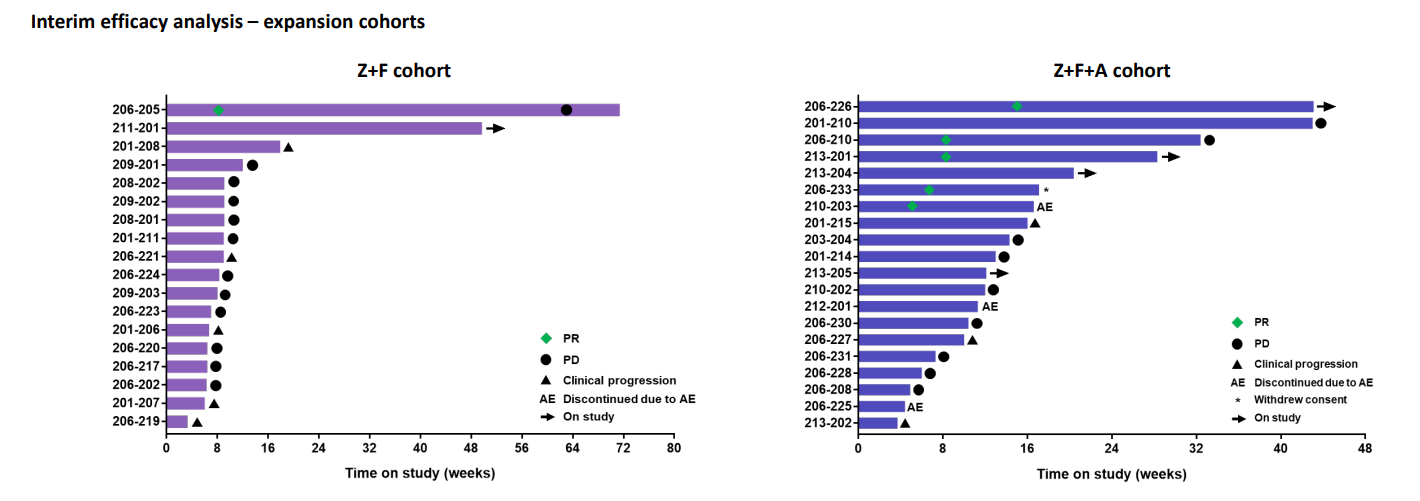

A poster revealed a 21% response rate among 19 patients treated with a zotatifin/fulvestrant/Verzenio triplet, with five partial remissions. A zotatifin/fulvestrant doublet generated a less impressive 6% ORR, including one partial response, in 17 patients. With dose escalation ongoing, the hope is that these will improve.

Doug Warner, Effector’s chief medical officer, told Evaluate Vantage that there were reasons why zotatifin is likely contributing to these responses, and why they are unlikely to be due solely to its doublet and triplet partners.

“You would expect to see response rates of around 10% in this late line population – we got around 20%. We are seeing early and deep responses, which you wouldn’t expect from fulvestrant and [Verzenio] in this population. All five partial responses had relapsed on prior CDK4/6 inhibitors, one of whom was a patient who had progressed immediately before coming on study,” he said alongside the poster presentation.

Zotatifin phase 1/2 trial (poster details, NCT04092673)

Further data from the recent dose escalation should emerge later this year, said Steve Worland, Effector’s chief executive officer. A recent fundraising – $7.5m was raised via an existing shelf and the sale of warrants – gives the group enough cash to finish the trial.

Effector came to market via a Spac in mid-2021. The bear market has not been kind to the stock, which has been trading under $1 for almost 12 months now. The Asco data provided a boost, but with a market cap of only $55m the company needs the dataset to continue improving.

Path forward

Zotatifin is described as a highly selective inhibitor of the RNA helicase eIF4A (eukaryotic translation initiation factor 4A). It is thought to work by targeting sequences found in several receptors, oncogenes and drivers of cell proliferation, particularly in ER-positive breast cancer.

“Zotatifin collects multiple resistant mechanisms; we’re not targeting certain subsets, so it’s potentially unrestricted” in its use, Worland said.

As for a future path forward, success in the PostMonarch trial could provide a potential control arm for a subsequent study. The Lilly trial is testing Verzenio plus fulvestrant against fulvestrant and placebo in previously treated ER-positive/Her2-negative breast cancer; all patients in the study are required to have been failed by CDK4/6 inhibition.

The results are keenly awaited because previous CDK4/6 rechallenge trials, albeit phase 2, have produced conflicting results. While the Maintain study generated a hit for Verzenio, the Pace study, testing Pfizer’s Ibrance, failed.

Confirmation that zotatifin has been hitched to an effective combination in this setting would be welcome news for Effector. Then the real work would begin: to show more than an incremental additional benefit.

– Amy Brown ([email protected])

This article originally appeared in Evaluate Vantage. Evaluate Vantage and Scrip are part of the same parent company, Norstella.