GSK Aims To Launch 13 Blockbusters In Five Years

Immuno-Oncology Central To Ambitions

Executive Summary

GSK achieved a first-in-class market oncology launch in 2020, but will have to increase that hit rate in order to fulfil its blockbuster ambitions.

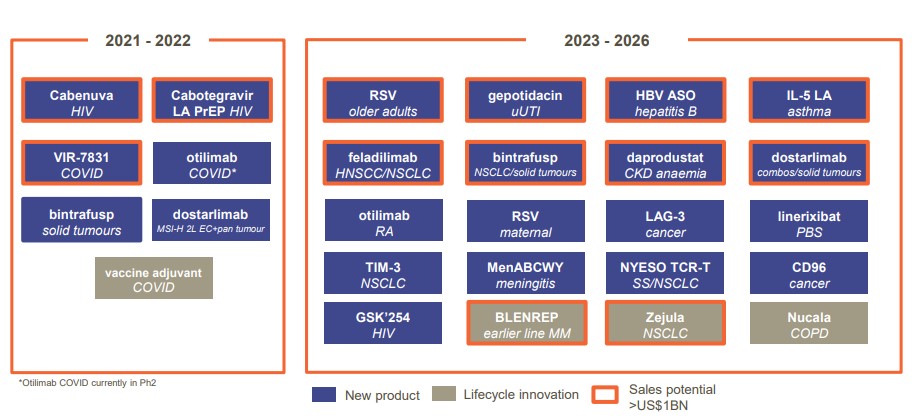

GlaxoSmithKline has unveiled a plan to launch 13 blockbusters between 2022 and 2026, with novel HIV and immuno-oncology therapies at the heart of this ambition.

The goal was unveiled last week by GSK’s chief scientific officer and president of R&D Hal Barron at the virtual J.P. Morgan healthcare conference, where investors were looking for progress in the company’s R&D turnaround process, now entering its fourth year.

The five-year plan to launch 13 products with $1bn plus annual sales includes five oncology drugs, two antivirals for HIV, and one vaccine, and is a clear shift away from the company’s reliance on its respiratory franchise, led by declining flagship Advair/Seretide (fluticasone propionate / salmeterol).

Barron joined the company in 2018 and soon identified the need to transform the company’s culture and productivity: he said R&D decision-making had become risk-averse and the commercial organization was failing to compete effectively.

GSK's late-stage pipeline and blockbuster hopefuls.

GSK

GSK's late-stage pipeline and blockbuster hopefuls.

GSK

Here, he included oncology, the sector’s most important therapy area, which GSK exited in 2014 only to later re-enter, and HIV, where the company lost its lead some years ago to rival Gilead.

Now working closely with CEO Emma Walmsley and commercial leader Luke Miels, his focus is back on novel therapies in cutting edge areas, including immuno-oncology, immunology, HIV and vaccines (see table).

The spin-off of GSK's consumer healthcare division is scheduled for summer 2022, and will create a new UK-listed company with a potential valuation of $40bn ($54.2bn). The hope is that this will leave behind a leaner, more innovation-focused and profitable GSK. This will focus purely on biopharmaceuticals and vaccines, something many investors have been long calling for.

Building Up In Immuno-Oncology

GSK took an important step back into oncology in August, when it gained US Food and Drug Administration approval for its refractory multiple myeloma therapy Blenrep (belantamab mafodotin). (Also see "GSK’s Blenrep Wins BCMA Race, Carries Ocular Toxicity Warning" - Scrip, 6 Aug, 2020.)

Blenrep is the first BCMA-targeting therapy to reach the market, but carries a black box warning that on eye toxicity. SC142744 To combat this, Barron said a new combination with a gamma secretase inhibitor from SpringWorks Therapeutics could allow Blenrep’s use at a lower dose and preliminary data on the combination – from the DREAMM-5 study – are expected by the end of the year.

Results of Blenrep’s first quarter sales will be unveiled at GSK’s Q4 results day on 4 February. Analysts at SVB Leerink forecast 2021 revenues of £37m ($50m), bolstered by the expected EU approval this year.

SVB believes these revenues can grow to £2.28bn ($3.09bn) by 2026, much higher than the consensus level of £791m ($1.07bn), but this will very much depend on pending results from CAR-T and bispecific competitors. The FDA is due to pass judgement on the first of these, BMS and bluebird bio’s CAR-T cell therapy idecabtagene vicleucel (Ide-cel, bb2121), by 27 March.

Another key cancer therapy already launched is the company’s PARP inhibitor Zejula (niraparib), and its potential as a combination with Merck & Co’s Keytruda (pembrolizumab) is seen as a major blockbuster hope in non-small cell lung cancer

The company is also looking at a combination of niraparib with dostarlimab, its own PD-1 inhibitor candidate. The Phase II MOONSTONE in women with platinum resistant ovarian cancer is expected to read out during 2021.

While of Blenrep is a first-in-class product, GSK knows it must develop one or two best-in-class compounds if it is to take a lead in oncology.

Among those hopes are a handful of other novel immuno-oncology agents, including the ICOS receptor agonist feladilimab, and bintrafusp alfa (a TGF-β/PD-L1 bifunctional protein).

Pivotal data from bintrafusp (which GSK is co-developing with Merck KGaA) in biliary tract cancer are due in the first half of 2021.

Overall, the company now has nine I-O agents and three cell therapies in its portfolio. Barron expressed confidence in the company’s progress in immuno-oncology, but warned this cutting edge science was risky: “Nothing is a slam dunk in immuno-oncology, that's for sure.”

HIV And Vaccines

Another key area is the company’s HIV franchise, led by joint venture ViiV. The market is currently dominated by Gilead’s combination therapy Biktarvy (bictegravir/emtricitabine/tenofovir.) but GSK hopes to challenge that with Cabenuva (cabotegravir plus rilpivirine), a once-a-month injection.

ViiV and J&J gained approval for Cabenuva in the EU in December, with US approval expected in early 2021.

Meanwhile, another novel product with great potential is the company’s respiratory syncytial virus (RSV) vaccine candidate in older adults.

RSV is best known as one of the most common cause of bronchiolitis, pneumonia and hospitalizations in infants. However, it is also dangerous for older adults, where it can trigger pneumonia as well as exacerbation of chronic obstructive pulmonary disease (COPD) and congestive heart failure (CHF).

The candidate vaccine is most advanced for use in expectant mothers, having just started its Phase III GRACE trial. The recombinant subunit pre-fusion RSV antigen (RSVPreF3) has shown promising safety and immunogenicity in a Phase I/II study in non-pregnant women. First data in pregnant women are expected to be presented later this year.

Vaccines are one of GSK’s strongest franchises, led by its blockbuster Shingrix, even though its revenues suffered during the pandemic in 2020, and the intense recent focus on vaccines, including the emergence of the first mRNA vaccines for COVID-19, are a challenge to GSK’s dominance in the area.

Moderna and BioNTech are intent on expanding their presence into infectious diseases such as flu, cytomegalovirus and RSV, and could move fast thanks to the proof of concept provided by their COVID-19 vaccines.

GSK is not looking to get left behind by the new technology, and signed a collaboration in July with another company, CureVac, centred on its self-amplifying mRNA (SAM) technology. (Also see "Coronavirus Update: GSK Signs Non-Coronavirus Deal With CureVac On mRNA Vaccines" - Scrip, 20 Jul, 2020.)

GSK will give investors a deep dive into its pipeline in June when it hosts an R&D day. Barron promised it would include details on how it was investing in novel vaccines against hard-to-treat diseases.