J&J Forges Ahead In Immunology Despite Competitive Dynamics

Executive Summary

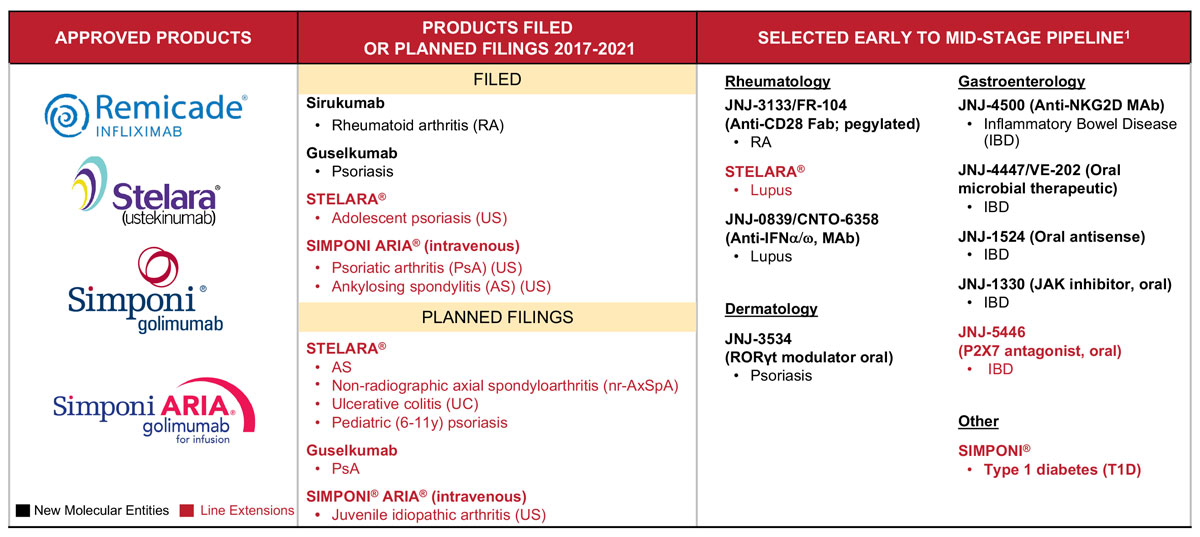

The diversified pharma has two NMEs and three sNDAs pending at FDA in immunology, as well as six more anticipated sNDA filings. Immunology Therapeutic Head Susan Dillon told investors why there is still plenty of opportunity for growth in key autoimmune diseases.

Johnson & Johnson has big expectations for immunology to contribute to the pharmaceutical division's overall growth from 2017 to 2021, powered by two new launches and line extensions for the marketed drugs Stelara (ustekinumab) and Simponi (golimumab).

Despite the increasingly competitive market dynamics in autoimmune diseases like rheumatoid arthritis, Crohn's disease and plaque psoriasis and biosimilar competition to its own blockbuster Remicade (infliximab), Global Therapeutic Head-Immunology Susan Dillon outlined J&J's bullish strategy for expansion during an R&D day May 18 in New Brunswick, N.J., near the company's campus.

"Collectively, this portfolio translates into a banner year with five potential approvals in the second half of 2017," Dillon said. "In addition, you can see several late-stage programs with a potential to generate a series of important line extension filings through 2017 and 2021."

Worldwide Chairman-Pharmaceuticals Joaquin Duato expects Remicade to remain a multi-billion dollar asset in 2021, despite biosimilar competition.

J&J's pharma growth strategy calls for achieving above-market compound annual growth over the five-year period, largely by building key cornerstone brands into "mega-blockbusters" and launching several new potential billion-dollar brands. (Also see "J&J Plots Five-Year Pharma Growth Plan Around Mega-Brands And Launches" - Scrip, 17 May, 2017.)

Two of those potential blockbusters – guselkumab for psoriasis and sirukumab for RA – are pending at FDA and fall under the immunology umbrella, one of five core therapeutic areas at the company. The other four are infectious disease and vaccines, cardiovascular and metabolism, oncology and neuroscience.

"Despite recent advances and truly transformational advances in the treatments for immune-mediated diseases, this group of diseases still represents a very important growing global health epidemic," Dillon said. Less than 20% of rheumatoid arthritis patients treated with biologics achieve remission, the majority of patients with inflammatory bowel disease do not achieve remission and 60% of Crohn's patients still require surgery, she said.

The immunology markets where J&J competes – rheumatology, dermatology and gastroenterology – are expected to grow from $56bn today to $63bn by 2021, she said, though J&J's internal research suggests the growth could be even more substantial.

J&J's Immunology Portfolio And Pipeline J&J R&D Day, May 17

Guselkumab Takes On Cosentyx

Guselkumab, a first-in-class interleukin-23 inhibitor developed at Janssen, is one of the drugs J&J is pinning its hopes on. The company unveiled a new brand name for the drug at the R&D presentation, Tremfya. J&J announced the regulatory filing in November and Dillon confirmed the company used a priority review voucher to expedite the review, positioning the drug for FDA approval mid-year.

The success of Novartis AG's interleukin-17 inhibitor Cosentyx (secukinumab), which catapulted into a blockbuster in its first full year on the market, points to the big opportunity for effective new options in psoriasis. Nonetheless, guselkumab will have to compete against Cosentyx and other IL-17 inhibitors that have recently debuted, as well as against well entrenched tumor necrosis factor inhibitors like Humira (adalimumab), which are expected to eventually face biosimilar competition.

J&J believes efficacy will pave the way for guselkumab, because IL-23 works upstream in the inflammatory cascade compared to IL-17 and TNF. To build a commercial case for guselkumab, J&J ran a Phase III trial comparing the IL-23 blocker head-to-head against Humira and demonstrated superiority. (Also see "Clever Marketing Needed To Position J&J's New Psoriasis Drug Ahead Of Cheaper Options" - Scrip, 1 Oct, 2016.) Dillon said the company has now kicked off a head-to-head trial comparing guselkumab to Cosentyx. Plus, she said that while the IL-17 inhibitors carry warnings on labeling related to IBD exacerbations, guselkumab has not shown any evidence in trials of IBD exacerbations.

And the company is already looking ahead to expanding guselkumab in new indications. A Phase III trial in psoriatic arthritis will begin enrolling patients in the third quarter, Dillon said, while the company has also decided to proceed with a Phase III program in Crohn's disease.

Sirukumab, partnered with GlaxoSmithKline PLC, for RA could also be approved in the second half of the year, but is likely to face commercial challenges given the competitive dynamics, particularly because it won't be the only IL-6 inhibitor on the market. Roche's Actemra (tocilizumab) is already available and Sanofi/Regeneron Pharmaceuticals Inc. have another IL-6 blocker pending at FDA, though their sarilumab has been held up due to a manufacturing issue.

J&J/GSK hope to build a case for sirukumab in patients who have failed on prior biologics. The SURROUND-T Phase III trial enrolled patients who failed on two or more biologics.

The clinical program for sirukumab also measured non-physical symptoms of RA, like fatigue, mood and quality of life, where significant improvements were seen. In fact, the data led J&J to consider studying sirukumab in an entirely different therapeutic area – depression. The company has initiated a Phase II study testing sirukumab in treatment-refractory major depressive disorder.

If approved, guselkumab and sirukumab would join J&J's existing autoimmune blockbusters, Stelara, Simponi and Remicade. Simponi generated $1.75bn in 2016, and Stelara generated $3.23bn in 2016. Remicade, J&J's top-selling workhorse, generated $6.97bn, the bulk of which came from the US, which saw the first launch of an infliximab biosimilar last year.

Current Blockbusters And Future Pillars

Increased biosimilar competition to Remicade is one reason investors are nervous about J&J's mid-term growth, though so far the launch of Pfizer Inc.'s Inflectra in November 2016 in the US hasn't had a big impact on sales. (Also see "Pfizer Will Support Inflectra Launch With Dedicated Sales Force" - Scrip, 14 Nov, 2016.) US sales of Remicade declined 2.4% in the first quarter.

Worldwide Chairman-Pharmaceuticals Joaquin Duato told investors that Remicade will remain a multi-billion dollar asset in 2021, citing the drug's long history since being approved in 1998 and the robust real-world evidence around it.

"As a result, physicians have a strong preference for Remicade versus biosimilars and we enjoy a very favorable access position in the US," he said.

Stelara, already approved for psoriasis, Crohn's disease and psoriatic arthritis, is poised for more growth, according to Duato, and is on track to become one of the company's cornerstone mega-blockbusters generating more than $4bn in sales. It was approved just last year for Crohn's disease, where management sees a big opportunity to drive sales. An sNDA for Stelara for adolescent psoriasis is pending at FDA, and more filings are planned for ankylosing spondylitis, non-radiographic axial spondyloarthritis, ulcerative colitis and pediatric psoriasis. The company is exploring Stelara for lupus as well.

Longer term, J&J is pushing ahead with research that it hopes will do more to disrupt autoimmune disease, and yield drugs that affect the underlying disease process rather than target the symptoms.

"Our early pipeline is focused on assets that, we believe, will achieve higher rates of remission as well as on modulating targets that will result in restoring immune tolerance and thus interrupt or intercept autoimmune disease," Dillon said.