Scrip Asks… What Will Happen In Orphan Drug Pricing In The Next Five Years?

Executive Summary

Feb 28 is Rare Disease Day. To mark the occasion, Scrip asked experts the question: Do you see orphan drug pricing coming under pressure over the next five years?

Having their say:

- Companies: Genzyme, Sanofi, Akari Therapeutics, Vertex Pharmaceuticals, MyoKardia, Shire

- Trade associations: EFPIA/EuropaBio Joint Task Force on Orphan Medicinal Products and Rare Diseases

- Health technology assessment bodies: UK’s NICE

- Health insurers: G-BA (Germany)

- US pharmacy benefits managers: Humana Pharmacy Solutions, Express Scripts

- Also, Bay Life Science Advisors, EURORDIS and Datamonitor Healthcare

The orphan drugs business is seen as one with high margins, high entry barriers and limited competitive pressure. But as the field matures, will those dynamics change? To mark Rare Disease Day on Feb. 28, Scrip asked experts the question: Do you see orphan drug pricing coming under pressure over the next five years?

We received a broad range of answers from an equally broad range of stakeholders – from the grandfather of orphan drug companies, Genzyme Corp., to newcomers such as Akari Therapeutics PLC and MyoKardia Inc., from industry groups EFPIA and EuropaBio to the G-BA, which decides on health insurance coverage in Germany, from patient organization alliance EURORDIS to US pharmacy benefits managers Express Scripts and Humana Pharmacy Solutions.

David Meeker, Head of Sanofi Genzyme

David Meeker

First, all pricing, including orphan drug pricing, is under pressure. Historically orphan drugs have in some situations or countries been carved out from a general pricing mandate but that is no longer the case.

Second, if you are in an orphan disease serving a population of 100,000-200,000, the pricing dynamic or mechanics of that population are very different than if you're serving a population of 1,000-5,000. And that's where the debate gets lost a bit, because people don't recognize that orphan is an arbitrary definition and rarity is a continuum.

Third, I actually feel that pricing in the ultra-rare orphan sense will be under less pressure because there is an understanding of the importance of the business model to the willingness of people – investors, companies – to invest in potential treatments or cures. It's a high price because there are so few patients; for any given patient it's perhaps not affordable for the patient, but at a systems level that's a small fraction of the population and the total amount spent on managing that disease is extremely low. With time they've come to understand that. What payers are pushing back on is "don't apply that same basic philosophy across the full spectrum."

“We shouldn't be hiding behind the orphan designation. To me your pricing is a function of the value, the rarity of the population you're addressing, the investments that you made to get to market.” – Sanofi Genzyme’s David Meeker

But we shouldn't be hiding behind the orphan designation. To me your pricing is a function of the value, the rarity of the population you're addressing, the investments that you made to get to market. We have to recognize that it's a continuum, that competitive forces will come into play the larger the population being served, and that phenomenon is accelerating everywhere. And it will accelerate within the orphan drug envelope too. And it has nothing to do with orphan or not orphan, it has simply to do with what is the target population, and can it support lower prices?

We're in endless discussions on a regular basis around the world about pricing. The discussion has become more intense and the pressures have become more, but the substance of those conversations hasn't changed over the 20 years we've been doing this.

[We need] to help people think about orphans not as one bucket… to really get people refocused on this idea of a continuum and [on the fact] that the pricing is really very much about the rarity, and that within the orphan drug there's a large range, or continuum, of rarity.

Elias Zerhouni, Global President of R&D, Sanofi

Elias Zerhouni

The real question is going to be the value that you provide for each [product] and there’s not a one price fits all.

So in orphan diseases what is the rare disease? Look at Genzyme. It’s a rare disease company... At most, it’s taking care of eleven thousand, twelve thousand patients. Well, it has six thousand employees so you can see that for every two patients we have an employee. If you say, 'I want to cut the price,' to such an extent that you cannot sustain that innovation, you would dry out the well for rare diseases.

It’s very, very hard to maintain the machine behind these patients that provides not only the innovation but also the support, the manufacturing and so forth.

“If you say, 'I want to cut the price,' to such an extent that you cannot sustain that innovation, you would dry out the well for rare diseases.” – Sanofi’s Elias Zerhouni

The business model, I think, of where there was an understanding that you needed to take the risk to develop drugs for five or six thousand people, that’s what it takes for that to happen. The problem that you have is when it’s used for a very different purpose, when these prices are not applied to very reduced populations.

Gur Roshwalb, CEO of Akari Therapeutics

A UK-based rare disease specialist

Gur Roshwalb

Not really. Take PNH [paroxysmal nocturnal hemoglobinuria], for example. Before Alexion Pharmaceuticals Inc.'s drug Soliris (eculizumab) came to market, people with PNH would die within five to ten years. That drug's appearance gave people with PNH back a normal life span, and these patients during those five to 10 years before its arrival were not leading a normal life. They were severely anemic and had a lot of medical problems. They are often diagnosed in their 30s and 40s and so this drug has really changed the path of these people and given them another 30 to 40 years of life. That's worth a significant sum of money.

“While it's true that any initial drugs in orphan areas might be expensive, [they pay] for very important innovation that brings important results further down the line.” – Akari’s Gur Roshwalb

And on the flip side, from the payer point of view, you're usually not talking about that many patients. These diseases are very rare, so for any given payer you might only have two or three, so that $1 million line item is just not something they're going to fight over. Also, a lot of medical innovation results from rare orphan disease. For example, the immune system part that we're targeting to treat PNH, called the complement pathway, the immune system does two things in the body – it identifies foreign stuff and it kills it. The complement pathway is one of the bridges between identification and the destruction, and in auto-immune diseases, complement plays a large role in doing the destruction.

Innovating the first complement therapy and hopefully bringing others to the market... can have a profound effect on the millions of people with auto-immune disorders over time. That first drug is expensive, but being able to innovate in that area will make a tremendous difference over time. So, while it's true that any initial drugs in orphan areas might be expensive, it pays for very important innovation that brings important results further down the line. So I feel there's a consensual balance currently between orphan drug innovators, government authorities and payers in accepting that that effective ecosystem permits rare disease innovation to trickle down over time into broader therapeutic areas.

Stuart Arbuckle, Chief Commercial Officer, Vertex Pharmaceuticals Inc.

A US-based specialist company with a focus on cystic fibrosis

With the recent explosion in understanding of the biology of disease, we have a new opportunity to fundamentally change the course of human health. Still, developing a transformative treatment for a rare disease requires a huge investment in terms of both money and countless hours from talented, dedicated scientists. If we are to fully grasp the opportunity in front of us, society needs pricing policies that incentivize this tremendous effort and ensure companies have the resources necessary to fund the next set of breakthrough medicines.

EFPIA/EuropaBio Joint Task Force on Orphan Medicinal Products and Rare Diseases

A European alliance of over 45 companies committed to the development of orphan medicinal products

The price of medicines, whether orphan-designated or not, is a topic of debate. In Europe, society shares the burden of disease and public budgets, including for health, are under unprecedented pressure with spending being carefully scrutinised.

Today, it is estimated that the budget impact of orphan medicinal products (OMPs) is approximately 4-5% of the total pharmaceutical spending in the largest EU countries that have the best access to rare disease treatments. This is less than 1% of the overall health expenditure. As more OMPs are developed, this figure may increase, but estimates show it should still remain a small portion of health spending in Europe. Also, as most OMPs were developed post-2000, we expect generic and biosimilar competition to grow, benefitting budgets.

“Before the European Orphan Medicinal Products Regulation existed, only eight orphan-like therapies were approved compared to the 130 currently approved.” – EFPIA/EuropaBio Joint Task Force on Orphan Medicinal Products and Rare Diseases

The European Orphan Medicinal Products Regulation was developed on the belief that patients suffering from rare conditions should be entitled to the same quality of treatment as other patients. Since 2000, the Regulation has been successful in incentivizing research and development of OMPs. Prior to the regulation, only eight orphan-like therapies were approved compared to the 130 currently approved. There seems to be a concern that the Orphan Regulation incentives are misused. We believe that the incentives are well balanced, with very stringent criteria for orphan designation based on distinct orphan conditions.

There is still enormous unmet medical need in rare diseases. Moving forward, it is important that the rare disease community build on the success of the European OMP Regulation and work closely together, including with payers, to continue supporting patients.

Tijana Ignjatovic, lead analyst for market access at Datamonitor Healthcare

Getting a successful reimbursement outcome for highly priced orphan drugs will get more difficult in the future. We have already seen some cases of this so far, with the recent restriction of reimbursement for Alexion Pharmaceuticals Inc.’s Strensiq (asfotase alfa) in the UK for hypophosphatasia. While the UK may be one of the most challenging markets, the difficulty Alexion has experienced with the reimbursement of Kanuma (sebelipase alfa) in France indicates that this is unlikely to be a trend confined to the UK. Kanuma was also recently rejected by NICE [the National Institute for Health and Care Excellence] due to its high price for use on the National Health Service in England and Wales to treat infants, children and adults with the rare inherited genetic disorder lysosomal acid lipase deficiency (LAL-D). NICE was not convinced the high cost of the drug – nearly £500,000 per patient – could be justified by its long-term treatment benefits in LAL-D patients.

The advent of multiple early/conditional market authorization pathways is resulting in reimbursement barriers for all drugs approved through these routes and orphan drugs are more likely to pursue these pathways. Consequently, they undergo health technology assessment (HTA) processes without full, mature datasets, resulting in uncertainty in the determination of their clinical effectiveness and also cost-effectiveness. Hence, managed entry agreements – which have already been put in place for some orphan drugs – are likely to be used more as a means to address the residual uncertainty. Meanwhile, small patient populations and treatments being available in specialist centers render these drugs highly suitable to participate in such schemes without requiring onerous administrative costs. Some payers (for example those in the Netherlands) have had mixed experiences with risk-sharing schemes for orphan drugs, but for many this approach will provide a compromise between ensuring patient access and value for the healthcare system.

In Germany, orphan drugs hold an advantage over other drugs in that by law they have to get an added benefit under the AMNOG early assessment, though it can be reassessed if their expenditure exceeds €50m per year. Recently, several groups including the German HTA body IQWiG have called for this rule to be abolished under AMNOG reforms, which signals another potential risk for the commercial success of orphan drugs in the future and the need to have a strong evidence base.

Have Your Say…

Yann Le Cam, CEO, EURORDIS-Rare Diseases Europe

Yann Le Cam

Orphan drug pricing is already under pressure today.

Demographic trends, the long lasting economic crisis, and unprecedented prices for innovative therapies for widespread conditions such as HIV or hepatitis C have put healthcare budgets under acute pressure. This, added to sometimes questionable high price practices by some manufacturers, has only made payers more concerned and reluctant.

But it is a matter of perspective. Today, orphan medicines still represent an extremely small fraction – well under 5% – of European pharmaceutical budgets. The prices of a vast majority remain uncontroversial: the median annual cost of all orphan medicines approved to date is only €35,000, with a quarter of them costing less than €12,000 per year and per patient. And a nominal price is never more than a weak indicator of what payers actually disburse.

The problem is not one of budget impact in absolute terms – orphan medicines are not the “last straw” that will lead ailing healthcare systems to bankruptcy.

“We should aim for the goal of a three to fivefold increase in the number of rare disease medicines approved by the European Medicines Agency per year by 2025, and those medicines available at one third to one fifth of the prices observed today.” – EURORDIS’s Yann Le Cam

For each new medicine coming to market, [what matters is] the determination of the right budget impact based on a given level of price, a given patient population, and a given level of uncertainty over what scientific data tell us about the product’s clinical efficacy and effectiveness.

For us, a key challenge of the next five years will be to drive the current model to become less disproportionately guided by financial considerations, and more oriented towards improving patient outcomes by generating the new clinical data needed to resolve scientific uncertainties.

We also call for stronger European cooperation to veer away from the current practice of price setting as a sterile “tug-of-war” between companies and payers, moving towards a more transparent system in which fair prices will be collaboratively constructed based on a series of mutually agreed elements.

Collectively, we should aim for the goal of a three to fivefold increase in the number of rare disease medicines approved by the European Medicines Agency per year by 2025, and those medicines available at one third to one fifth of the prices observed today.

Sheela Upadhyaya, Associate Director, Highly Specialised Technologies Programme, UK National Institute for Health and Care Excellence

There is an increasing number of drugs coming through the pipeline that have orphan status, some of which are subsets of more common conditions. It is no secret that the budgets for healthcare in all countries are challenged. Together with the pressure to support innovation and improve access to new drugs, it means pricing will be an increasingly important consideration when bringing a drug to market.

Stakeholders across all parts of the system will need to create novel approaches to pricing and reimbursement so that healthcare budgets can be sustainable.

Thomas Müller, Head of Pharmaceutical Department, Gemeinsame Bundesausschuss (G-BA)

The G-BA is the federal body that decides on health insurance coverage in Germany

Müller believes that pressure on companies will increase and that there will be high-level debate about the issue across the EU. Prices are a big obstacle to patient access in different European countries, he says, particularly those which carry out health economic evaluations, such as the UK, and those where there are economic troubles, like in southern Europe and Eastern Europe. Müller believes solutions can be found at a European level and that the subject will be an important topic for debate.

“Companies use orphan status to implement very high price levels for new drugs,” he says. “We have seen very high entry price levels for new orphans. In Germany, the share of orphans is still low – maybe 5-10% of the drug budget, but it is very dynamic, so that is worrying politicians.”

Müller believes that there should be more consideration of the European Medicines Agency’s criteria for awarding orphan status. “Maybe in a third of G-BA procedures we have seen there is not really a basis for orphan status, for example in pulmonary hypertension there are a lot of treatment options.”

He also believes that incentives for developing orphan drugs need to be better balanced and combined with an approach to arrive at more sustainable pricing levels. “There is a paradox,” he says. “On one side, the EU is incentivizing investments for orphan drugs but then the price levels are voiding access in several member states.”

Müller says that there will be amendments to the EU Transparency Directive, which lays down a common framework for member states’ pricing and reimbursement procedures, that will find a new approach to improving access to orphan drugs across the EU. In addition, Müller points to incentives for managed entry agreements as a potential solution.

“Maybe in a third of procedures we have seen there is not really a basis for orphan status.” – G-BA’s Thomas Mueller

Tassos Gianakakos, CEO of MyoKardia

A specialist US-based company with a focus on rare cardiovascular diseases

I think the answer is yes. There might even be signs that we're seeing it now … I think this is such an emotive topic that the transparency around pricing, and even for orphan drugs this notion of really properly articulating value to the system, I think that's here to stay. So I think most drug discovery/drug developers today are thinking about value and making sure they can frame out a pharmacoeconomic value no later than Phase II. We're certainly thinking about it. I would be surprised if other orphan discovery and development companies aren't as well.

We have to get this balance right as an industry, around access and innovation, but you want to make sure that that balance still provides enough incentive for investors and doesn't necessarily undercut the incentives that the [US] Orphan Drug Act was meant to highlight and drive.

This disease area [heritable cardiomyopathies] is one where I would say if it wasn't for companies like MyoKardia and its investors, these heritable cardiomyopathies would likely still be rare, neglected diseases, and without a whole lot of attention being paid to them. So if we want to reward the investors appropriately, we've got to make sure we're creating enough value not only for us.

“This notion of really properly articulating value to the system, I think that's here to stay.” – MyoKardia’s Tassos Gianakakos

Hartmann Wellhoefer, VP, Head of Genetic Diseases, Medical Affairs, Shire

Hartmann Wellhoefer

When I joined Shire five years ago, there was little pricing pressure in the rare disease space; there were maybe one or two countries where pricing was an issue. Now, rare diseases are moving in the same direction as the rest of the industry. We, as a company, need to generate data [to support our pricing]. It's a great opportunity and a great challenge for our company. We are changing people's lives. Children with rare diseases are becoming adults. We're trying to push the field forward and make sure the benefit of new medicines gets to patients. Even if you have a disease you think you know well, you still have a lot to learn.

Stephan Gauldie, Senior VP of Strategy Consulting, Back Bay Life Science Advisors

A US advisory and strategic consulting group focusing on life sciences

For us, a lot of the work we're doing is in orphan disease with smaller companies who are positioning themselves to be acquired or to exit and we do diligence work for larger companies that are looking to acquire these kinds of assets. So pricing is always an issue and it's always an assumption that we have to make as part of the development programs.

I would say for the time being, and it's sort of evolved a bit, typically it was the case that you would assume similar pricing, US to Europe, for orphan-type products. That has kind of evolved, and again we do a lot of our work benchmarking existing products and using analogues, so it's increasingly the case that we do see a European discount versus the US, which has evolved over the last couple of years. So we would assume that kind of continues to evolve. So I think there will be sort of a regional dynamic in what the market is willing to pay for these orphan products.

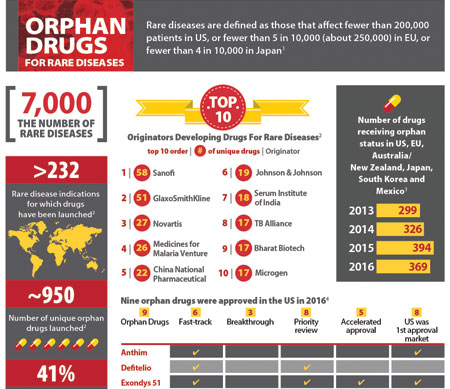

Pharma's Orphan Drug Activity, An Infographic

In the US, in the work we do, when we're talking about individual products and if we're speaking to payers, at the moment it's no one individual product that really shows up on the register of a large payer. They may only have a handful of patients with that particular orphan disease, so it's almost more bother for them to implement lots of step-throughs and things for an individual product. What is increasingly an issue is the total cost for all orphan products that a plan is bearing the cost of.

It's very tough to say [what might happen then]. I don't think you can put a specific finger on it. I think some of the larger, integrated plans like Kaiser are beginning to look at the total cost, so if those become more the way of things, I guess I can see a little more pressure coming to bear. If that isn't the case, like I said, any one individual plan is unlikely to put into place things for an individual product. It's going to have to be a more global approach to things, and to have something global put into place is probably not in the three-to-five year timeline, I think.

[As to variations between orphan drug pricing in Europe and the US,] just going on the trends, I think it's probably going to differ as well. Even in Europe, many of these products don't go through any health economics process to justify the high price. Now, if they did start to apply HTA-type things, then I think you're going to see pressure coming a lot quicker, but a lot of it may come down to innovation. If you're talking about a repurposing of a generic for an orphan indication and trying to justify an enormous price, that sort of thing doesn't fly very well in Europe. So, it may be a case that orphan and innovation still generates the large prices, but orphan plus lack of innovation doesn't provide the same pricing.

Glen Stettin, Senior VP for Clinical, Research and New Solutions at Express Scripts

A US pharmacy benefits manager

Glen Stettin

I think for any very high priced products there will continue to be pressure because when you have patients who are in high deductible plans who may not qualify for any kind of patient assistance, a drug may be priced at $100,000 or $500,000 and those patients are still paying several thousand out-of-pocket, which for nearly everyone, is real money.

The second [issue] is for the plans. When plans look at affordability of the benefit and you have folks whose treatments are fabulously expensive, that threatens the affordability of benefits for everyone.

Think of certain treatments, like bypass surgery or for a premature baby, those events don’t usually happen to the same person every year. But with orphan medications, while they very often can be life changing and can do great things for people, when that person costs [their health plan] $500,000-$1 million every year, year-in and year-out, when you think about some of these small companies that self-insure, it’s just very, very expensive.

“When plans look at affordability of the benefit and you have folks whose treatments are fabulously expensive, that threatens the affordability of benefits for everyone.” – Express Scripts’ Glen Stettin

So those kinds of prices will continue to put the manufacturers in the spotlight and from the total affordability of healthcare, which we all need access to, we have to think about it. Some of it is, can we do something different and better as it relates to the pricing of those drugs? As well as can we create headroom elsewhere? When people switch from branded products to generic products or from one brand to another that is less expensive but just as likely to help somebody do well with their condition and stay healthy, that saves money for everyone and helps us afford the next innovations.

William Fleming, President of Humana Pharmacy Solutions

A US pharmacy benefits manager

William Fleming

Manufacturer pricing decisions on all drugs, whether they have an orphan designation or not, will continue to be a material concern to all stakeholders and payers. Orphan drugs are intended for small or vulnerable populations and the prices set by manufacturers present significant barriers to patient affordability.

The FDA extends an accelerated approval process for many of these drugs which presumably should produce lower drug costs, not higher. Although manufacturers balance the costs of drug discovery while addressing areas of unmet medical need, they must be transparent about the drug discovery costs for these rare diseases. We see a concerning trend of orphan-designated drugs that frequently receive secondary FDA approvals or guideline-supported off-label uses that have no relevance to the Orphan Drug Act and seem to waste the resources and incentives the Act provides.

“Orphan drugs are intended for small or vulnerable populations and the prices set by manufacturers present significant barriers to patient affordability.” – Humana Pharmacy Solutions’ William Fleming

Reporting by Joseph Haas, Sten Stovall, Mandy Jackson, Cathy Kelly, Lucie Ellis, Francesca Bruce, Eleanor Malone and Maureen Kenny.