Start-Up Quarterly Statistics, Q4 2011

This article was originally published in Start Up

Executive Summary

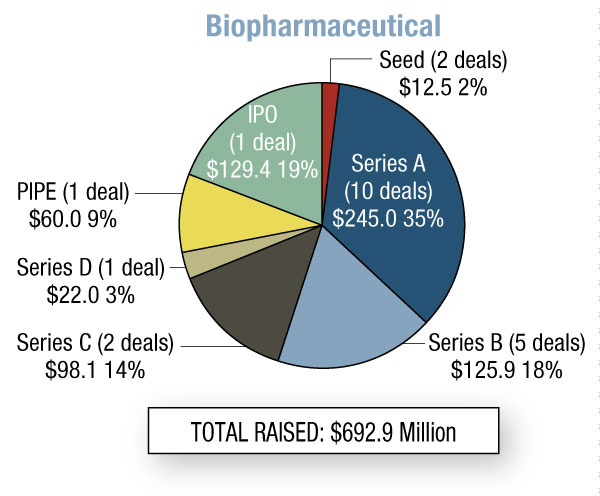

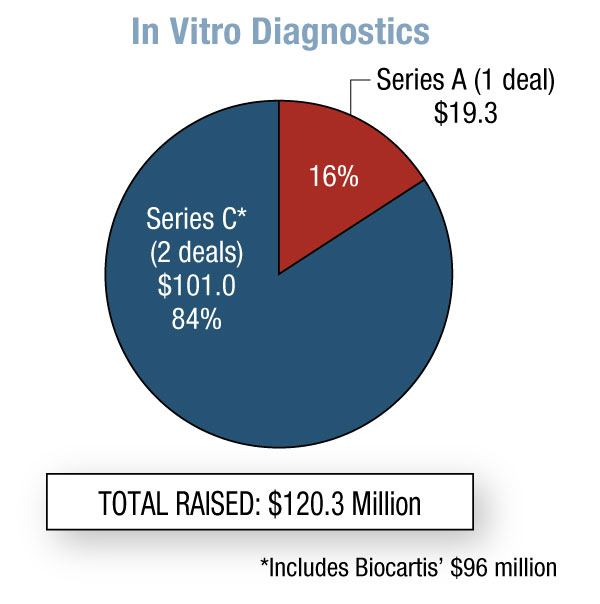

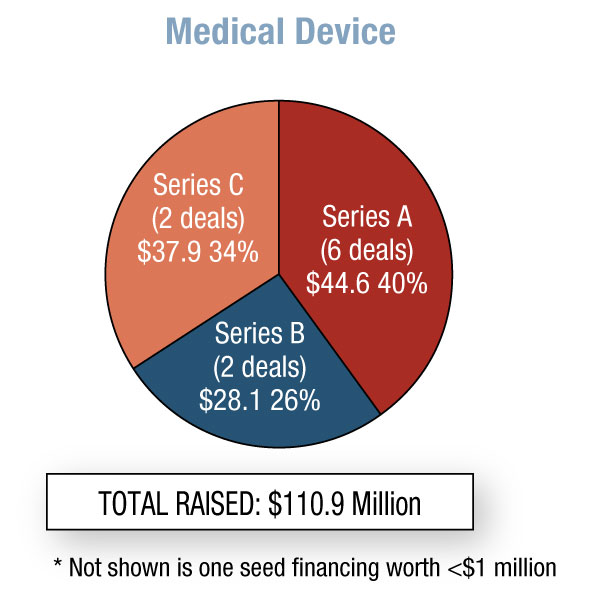

Biopharma start-ups raised $693 million in Q4 2011, up 131% from Q3. Device companies brought in $111 million, and diagnostics firms raised $120 million total, $96 million of which was from Biocartis’ Series C. Cancer was the most prevalent therapeutic area for biopharma alliances. And in great contrast to Q3’s one M&A deal involving a start-up company, Q4 saw nine start-up acquisitions.

Financings

In the fourth quarter of 2011, biopharma start-ups raised a whopping $693 million – 131% more than Q3. This is the most money generated in this sector since we started running this Quarterly Statistics column in START-UP four years ago. Worth noting is the variety of financing types – seven – that took place in the biopharma category. Medical device companies raised $111 million, down 17% from the previous quarter, and 40% went to Series A rounds. In vitro diagnostics start-ups are finally on the radar, with a total of $120 million raised; however, $96 million was from Biocartis NV’s Series C round. [See Deal] The first two quarters of 2011 saw no diagnostic start-up fundraising, and during Q3 only $10 million was raised.

Exhibit 1

Start-Up Financings, Q4 2011

Elsevier’s Strategic Transactions

During Q4, there was one finalized IPO, Clovis Oncology Inc., which netted $129 million through the sale of 10.7 million common shares at $13. [See Deal] The company originally thought it would raise up to $149.5 million. (See (Also see "Clovis Oncology Seeks $149.5 Million IPO" - Pink Sheet, 23 Jun, 2011.).) Clovis was established in April 2009 by the former management team of cancer company Pharmion, following Pharmion’s late 2007 acquisition by Celgene Corp. [See Deal]Like Pharmion, the founding executives took Clovis from private to public within three years. The start-up is in-licensing oncology therapeutics for certain cancer subtypes, and also working on companion diagnostics. It acquired its lead compound CO101 – a lipid-conjugated version of gemcitabine in Phase II for metastatic pancreatic cancer – from Aqualis ASA in late 2009. [See Deal] Clovis is partnered with Roche’s Ventana Medical Systems Inc. to develop a companion diagnostic for CO101. [See Deal] Clovis was one of several oncology-focused start-ups raising funds during the fourth quarter of 2011. In fact, 47% of the biopharma fundraising came from firms with cancer pipelines. (See Exhibit 2.)

Oncology discovery start-up Verastem Inc. raised $20.1 million in a Series C round. [See Deal] It is developing cancer stem cells using technology from Massachusetts Institute of Technology’s Whitehead Institute for Biomedical Research. Shortly after the Series C, Verastem filed for its initial public offering. [See Deal] The pending IPO caught the attention of industry analysts because of Verastem’s young age. Clovis, mentioned above, was the only other start-up to have filed for an IPO in the last two years.

The Series C round of Agios Pharmaceuticals Inc., another cancer biotech, is also worth noting. [See Deal] It brought in $78 million to continue development of its pipeline of cancer metabolism therapies, and to explore the area of genetic disorders, specifically inborn errors of metabolism.

October was busy for cancer drug company Puma Biotechnology Inc. In just one month, it started operations, reverse-merged with shell company Innovative Acquisitions Inc. to become public, [See Deal] raised money privately [See Deal], and in-licensed the late-stage breast cancer candidate neratinib from Pfizer Inc.[See Deal] (See (Also see "Puma Biotechnology Licenses Neratinib From Pfizer; Raises $55 Million" - Pink Sheet, 6 Oct, 2011.).)The firm was launched by former Cougar Biotechnology founder and CEO Alan Auerbach, and soon after brought in $60 million via a two-tranche private placement. Money from the PIPE was earmarked for development of neratinib.

Exhibit 2

Venture Rounds By Cancer-Focused Start-Ups

|

Date |

Company |

Round |

$ Raised (Millions) |

|

October |

Cleave Biosciences |

A |

42 |

|

|

Puma Biotechnology |

PIPE |

60 |

|

November |

Agios Pharmaceuticals |

C |

78 |

|

|

Clovis Oncology |

IPO |

129.4 |

|

|

Verastem |

C |

20.1 |

|

|

Total Raised = $329.5 Million |

|

|

Elsevier’s Strategic Transactions

Two drug developers – Dermira Inc. (dermatology) and Cleave Biosciences Inc. (cancer) – tied for the top spot in Series A fundraising, with $42 million. [See Deal][See Deal] Both companies were founded in 2010. Concurrent with the round, Dermira acquired dermatology/inflammation drug developer Valocor Therapeutics Inc.[See Deal] Its Series A funds will support development of Valocor's pipeline, including the topical photodynamic therapy lemuteporfin for acne. Cleave Biosciences has disclosed little about its pipeline, though sources say possible indications include solid tumors and multiple myeloma; the company says the recent funding should last for about three or four years.

Rempex Pharmaceuticals Inc. was the breadwinner among Series B rounds, raising $67.5 million. [See Deal] The company was founded in June 2011 with infectious disease assets from Mpex Pharmaceuticals, which was acquired two months earlier by Axcan Pharma (now Aptalis Holdings Inc.). [See Deal] Axcan was attracted to Mpex's Phase III Aeroquin (aerosolized levofloxacin) and divested the remaining preclinical compounds to Rempex, which plans to seek FDA approval for a gram-negative therapeutic and file an IND for another candidate in the first half of 2012.

Among medical device start-ups, Pivot Medical Inc. brought in the most money with a $32.4 million Series C round. [See Deal] The company specializes in minimally invasive hip restoration and plans to use the new funds to launch its Pivot system, which will enable physicians to perform hip arthroscopies more safely, easily, and efficiently.

Six device start-ups raised Series A money in Q4. Concurrent with its spin-off from cardiovascular device maker Arsenal Medical Inc., 480 Biomedical Inc. raised $15 million in Series A funds led by returning Arsenal Medical backers. [See Deal] 480 will be working on a clinical-stage bioresorbable scaffold for occlusive disease in the superficial femoral artery.

As mentioned earlier, four-year-old Swiss molecular diagnostics developer Biocartis closed a $96 million Series C round, the largest private financing for a diagnostics company since July 2010 when Pacific Biosciences of California Inc. brought in $109 million via its Series F round. [See Deal]

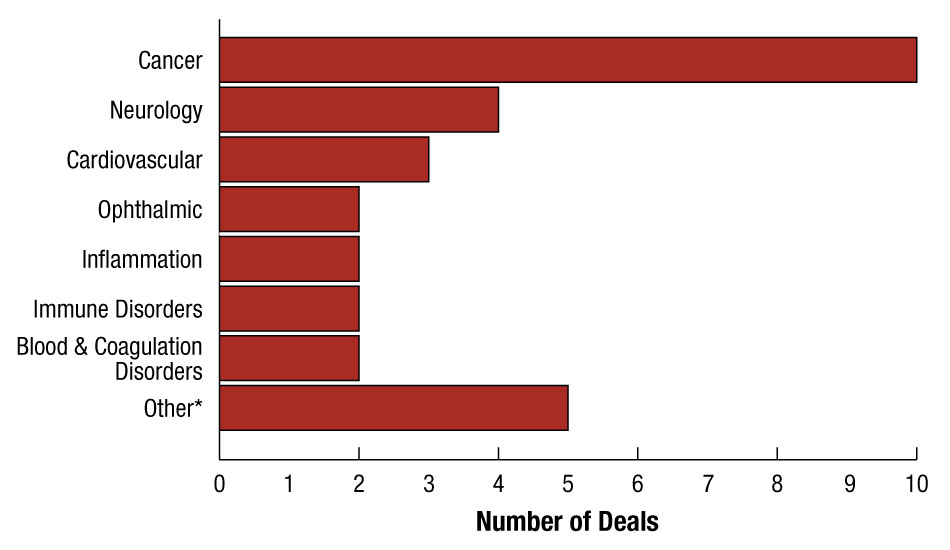

Alliances

During the fourth quarter of 2011, 10 of the 24 biopharmaceutical alliances involved cancer compounds. (See Exhibit 3.) Three of those oncology deals were penned by Johnson & Johnson or its subsidiaries. The Big Pharma’s Janssen Pharmaceutica NV licensed BeiGene (Beijing) Co. Ltd. exclusive rights to Phase II intetumumab (CNTO95) in Australia, China, Hong Kong, New Zealand, Korea, Singapore, and Taiwan, and Phase I MTKi327 worldwide. [See Deal] Less than two weeks later, Foundation Medicine Inc. teamed up with Janssen R&D LLC to use its clinical cancer genomic test to help identify biomarkers for J&J’s oncology therapy programs. [See Deal] (See (Also see "Foundation Medicine Seeks "Go-To" Companion Diagnostic Status For Sequencing Test" - Medtech Insight, 20 Jun, 2011.).) In December, Janssen Biotech Inc. received a limited exclusive license to cancer drug targets identified using Metamark Genetics Inc.'s Prognosis Determinants platform. [See Deal] The deal could potentially be worth up to $365 million in pre- and post-commercialization milestones, plus undisclosed up-front money and royalties.

And outside the area of cancer, J&J’s RespiVert Ltd. allied with recently formed TopiVert Ltd., licensing the start-up exclusive rights to use its IP to discover and develop narrow spectrum kinase inhibitors (NSKIs). [See Deal] TopiVert got rights to compounds for conditions including uveitis and inflammatory bowel disease, while RespiVert retains rights for indications including inflammation of the lungs. As part of this agreement, RespiVert received a non-controlling equity stake in the start-up. Concurrently, TopiVert completed a $12.5 million seed round to Imperial Innovations and SV Life Sciences. [See Deal] TopiVert will focus on developing topical treatments for inflammatory diseases of the eye and gastrointestinal system.

Exhibit 3

Biopharma Start-Up Alliances By Therapeutic Area

* Includes one deal in each of the following therapeutic areas: Gastrointestinal, Infectious, Metabolic, Musculoskeletal, and Respiratory/Pulmonary.

Note: Exhibit does not include one deal where no therapeutic category was indicated, and includes several alliances covering multiple therapy areas.

Elsevier’s Strategic Transactions

During the month of October, Ligand Pharmaceuticals Inc. inked agreements with two different start-ups. It first licensed Chiva Pharmaceuticals Inc. worldwide rights to the osteoporosis drug Fablyn (lasofoxifene). [See Deal] Chiva, which was founded in 2010, is planning to launch Fablyn in the EU soon. This is the second deal between Chiva and Ligand this year; in January the start-up got development rights to two Phase II liver programs – pradefovir for hepatitis B and MB07133 for hepatocellular carcinoma. [See Deal] In Ligand’s other Q4 alliance, it exclusively licensed Captisol to SAGE Therapeutics Inc. Captisol is designed to link a modified cyclodextrin derivative to IV and topical drugs, thus improving their solubility, bioavailability, stability, and pharmacokinetics. SAGE will apply the technology to its positive and negative allosteric modulators for neurology diseases. [See Deal] (Ligand acquired Captisol through its early-2011 purchase of CyDex Pharmaceuticals. [See Deal]) The Ligand deal was penned just one day after SAGE secured a $35 million Series A financing from Third Rock Ventures. [See Deal] (See (Also see "Third Rock Wise To The Opportunity In CNS; Stakes SAGE Therapeutics With $35 Million" - Pink Sheet, 18 Oct, 2011.).)

One joint venture was formed during the fourth quarter of 2011. Samsung Electronics Co. Ltd.’s Samsung BioLogics and Biogen Inc. created a South Korean JV to develop, manufacture, and market biosimilars. [See Deal] Samsung contributed $255 million, giving it an 85% stake, and Biogen added $45 million for the remaining 15% share. Samsung BioLogics itself is a joint venture that was established in February 2011 to provide contract manufacturing services for biosimilars. It is owned 90% by Samsung Electronics and 10% by Quintiles Transnational Holdings Inc.[See Deal]

Three device alliances were inked during Q4. In October, Sorin Group SPA purchased $7 million in Enopace Biomedical Ltd. equity to fund the start-up’s initial clinical studies of a neuromodulation system for congestive heart failure. [See Deal] A month later, AptarGroup Inc. made a $3.2 million investment – for a 20% stake – in self-injectable drug delivery device start-up Oval Medical Technologies Ltd.[See Deal] As part of that agreement, AptarGroup also paid an undisclosed up-front fee to secure rights to Oval's auto-injector IP.

Two in vitro diagnostics deals were signed during Q4, both involving start-up companies in-licensing IP from research institutions. Biomarker firm ADx NeuroSciences NV received exclusive worldwide rights from [Katholieke Universiteit Leuven] to antibodies that target phosphorylated tau aggregates. [See Deal] ADx, a 2011 KU Leuven spin-out, intends to use the licensed antibodies in diagnostics for Alzheimer's disease. To close out the fourth quarter, two-year-old molecular diagnostics firm OvaGene Oncology Inc. got exclusive global rights to the University of South Florida’s H. Lee Moffitt Cancer Center & Research Institute's IP surrounding microRNA-based cancer drug prediction assays. [See Deal] OvaGene is initially looking to create an assay for advanced ovarian cancer patients.

Acquisitions

In contrast to the previous quarter in which there was just one acquisition involving a start-up, the fourth quarter of 2011 had a total of nine mergers – five in the biopharma sector and two each in the diagnostics and medical device industries.

Takeda Pharmaceutical Co. Ltd. ponied up $190 million in cash for private oncology and inflammation therapeutics developer Intellikine Inc., plus another potential $120 million in earn-outs based on certain clinical development milestones. [See Deal] Intellikine’s two lead projects are small molecule kinase inhibitors that selectively target isoforms of the PI3K/mTOR pathways. INK128 is expected to commence Phase II in 2012 for solid tumors and multiple myeloma, and INK1117 is in Phase I for solid tumors. Both candidates will join the pipeline of Takeda’s cancer unit Takeda Oncology

Takeda wasn’t the only Big Pharma making start-up acquisitions. Pfizer scooped up four-year-old Excaliard Pharmaceuticals Inc. for an undisclosed sum in addition to earn-outs. [See Deal] Excaliard started operations four years ago, raising with $15.5 million in a Series A financing [See Deal] and concurrently acquiring exclusive global rights from Ionis Pharmaceuticals Inc. to antisense therapeutics for the localized treatment of fibrotic diseases including scarring. [See Deal]

Roche also got in on the action but not on the pharma side. Its Roche Diagnostics Corp.’s Roche Professional Diagnostics paid $15 million up front in cash, plus $3 million in possible earn-outs, for laboratory coagulation analysis firm Verum Diagnostica GMBH, a subsidiary of German medtech company Dynabyte Informationssysteme GMBH. [See Deal] Verum was launched in 2010 taking on all of Dynabyte’s diagnostic assets, most importantly Multiplate, a ten-minute test that monitors a person’s platelet function in whole blood. The product is available in over 35 countries and has applications in anesthesia, interventional cardiology, surgical, or intensive care settings to identify platelet dysfunction, monitor anti-platelet medication post heart attack or stent placement, or test for aspirin resistance.

The start-up acquisition with the highest potential deal value (up-front money and earn-outs) was CR Bard Inc.’s purchase of cardiovascular device developer Lutonix Inc. Bard shelled out $225 million initially and could pay out an additional $100 million pending the PMA approval of Lutonix’s Moxy drug-coated percutaneous transluminal angioplasty balloon for treating coronary and peripheral artery stenosis due to atherosclerosis. [See Deal] Bard anticipates a European launch of the device for peripheral applications in the second half of 2012. (Coronary indications will be pursued in the future.) The company plans to submit a PMA in 2014, with a US launch expected by 2015. If successfully marketed in the US, Moxy would be the first available drug-coated balloon. (See (Also see "Bard Buys Lutonix For Lead In Race To U.S. Market With Drug-Coated Balloon" - Medtech Insight, 2 Jan, 2012.).)

In terms of up-front money, the clear winner for start-up M&As among all industries was Salix Pharmaceuticals Ltd. with its $300 million cash purchase of private biomaterials firm Oceana Therapeutics Inc.[See Deal] The deal was GI-focused Salix’s first foray into the device field. Through the deal it gained Oceana’s two products, Solesta for fecal incontinence and Deflux for vesicoureteral reflux, which are regulated by FDA as Class III devices. (See (Also see "Salix Expects Acquisition Of Oceana, Two Products, To Be Quickly Accretive" - Pink Sheet, 9 Nov, 2011.).) These bulking agents are composed of dextranomer microspheres and hyaluronic acid molecules and have been available in the US since 2001.