NAS in 2012: launch tally is century's best

This article was originally published in Scrip

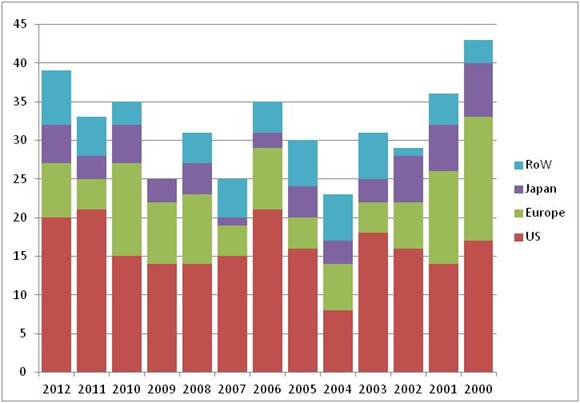

R&D in the international pharmaceutical industry appears in ruder health than some might think. In 2012, the number of new active substances (NAS) launched in their first markets worldwide hit 39 – the highest tally since 2000, new research from Scrip Intelligence has found.

A substantial portion of these products were also first in class, reinforcing the notion that innovation is alive and well. However, closer inspection reveals that much of the creativity for 2012's crop of products did not originally lie with the big pharma companies that are now marketing them. The list also confirms the growth of oncology as the lead area in terms of both numbers of products and their novelty.

best in years

2012's launch tally of 39 is a hike on last year's total of 33, which was itself a substantial increase over the average for the previous 10 years of 29 (see chart), although one product, Omontys, has already suffered the indignity of a market recall because of safety concerns.

Once again, a good proportion of 2012's new products are truly novel in their therapeutic strategies: 11 are first in class (see table). While this is a slightly lower proportion than the 33% in 2011, it is still a much higher proportion than the 11% reported in 2010. For this analysis, NAS are defined new chemical and biological entities with therapeutic effects marketed for the first time, and excluding new formulations, combination products and generics/biosimilars.

Perhaps reflecting its dominance of the pharma industry as a whole, the US remained the most popular market for first launches, accounting for more than 50%, with 20. This percentage is equivalent to the proportion of companies headquartered in the US. Of the industry's two other traditional heartlands, Europe pipped Japan with seven versus five launches, with the rest of the world making up the final seven. This geographical spread has held more or less steady since at least 2000, but once again there was a healthy showing for South Korea, with three first launches in 2012, reflecting its growing presence as an Asian R&D powerhouse; its far larger neighbor, China managed two launches.

First NAS launches worldwide by market 2000-2012

The top 20 companies by pharma sales had a hand in developing and/or marketing just over half of the new products (20), but the truth of Big Pharma's own internal productivity is that only six were discovered and then taken to market in-house.

Pfizer, for example, had a very good year with five NAS launches, but only one of these appears to have originated at the company – Xeljanz (tofacitinib). The others have either been licensed in (Elelysi came from Protalix, while Inlyta was discovered through a collaboration with OSI Pharmaceuticals (before the acquisition by Astellas)) or were obtained through acquisitions: Bosulif (bosutinib) came from Wyeth while Vyndaqel (tafamidis meglumine) originated at FoldRx Pharmaceuticals.

Other major pharma concerns putting in a good performance were Sanofi with three products, while GSK and Roche each racked up two launches. But again, the in-house showing was low. Aubagio may have been discovered at the Aventis predecessor Hoechst Marion Roussel, but Zaltrap came through Regeneron, and Imojev through Acambis. GSK had one of its two products being birthed at the company (Nimenrix) but ABThrax originated at Cambridge Antibody Technology (later acquired by AstraZeneca), while Roche similarly invented one of its two products, the breast cancer product Perjeta (pertuzumab).

popular indications

Cancer indications account for just over one third of the new launches, or 14, making it the most active area, with the metabolic segment the second most popular at 20%.

This suggests that the trend towards oncology R&D since the start of the century as molecular discoveries opened new avenues for drug development is now showing fruit. Of the more interesting cancer products approved during the year were Roche's first-in-class hedgehog pathway inhibitor for basal cell carcinoma Erivedge (vismodegib; in collaboration with Curis) and Kyowa Hakko Kirin/OncoTherapy Science's CC chemokine receptor 4 antagonist Poteligeo (mogamulizumab). Also entering the breast cancer market was Roche's Perjeta for use in previously untreated HER2-positive metastatic breast cancer in combination with the older targeted anticancer Herceptin (trastuzumab) and chemotherapy. This heir to Herceptin binds to a different part of HER2 from Herceptin and prevents dimerization with other HER receptors.

Rheumatoid arthritis enjoyed some novelty with two first-in-class launches: Pfizer's Janus kinase I and 3 inhibitor Xeljanz (tofacitinib) in the US and Simcere Pharmaceuticals' iguratimod (Iremod) in China. The Janus kinase target featured for the first time in last year's NAS list, when Incyte's Jakafi (ruxolitinib), a JAK 1 and 2 inhibitor, was launched for myelofibrosis.

But the anti-infective launches remained firmly in the antiviral segment, with no new antibiotics reaching the market in 2012. China saw the launch of the first hepatitis E vaccine and Australia the first vaccine for Japanese encephalitis, Sanofi's Imojev (after a long pause following approval).

The metabolic area saw some novel new treatments for rare diseases such as Gaucher's (Portalix/Pfizer's Elelyso (taliglucerase alfa)), Cushing's (Signifor (pasreotide)), and cystic fibrosis (Vertex's Kalydeco (ivacaftor)). Otherwise, it was dominated by a glut of new DPP-IV inhibitors for type 2 diabetes.

Further analysis of how NAS launches have changed over the years will be published in Scrip Intelligence in due course.

First NAS Launches Worldwide in 2012

| Generic name (trade name)

| Company

| Indication

| Mechanism of action

| Country of first launch

| Month of first launch

| First in Class

|

| aclidinium bromide (Eklira Genuair)

| Almirall

| chronic obstructive pulmonary disease and chronic bronchitis

| muscarinic M3 receptor antagonist

| Denmark

| Sep

| No

|

| allogeneic cultured keratinocytes and fibroblasts in bovine collagen (Gintuit)

| Organogenesis

| gingival regeneration

| allogeneic cell-based therapy

| US

| Apr

| YES

|

| anagliptin (Suiny/Beskoa)

| Sanwa Kagaku Kenkyusho/ Kowa

| type 2 diabetes

| dipeptidyl peptidase 4 (DPP IV) inhibitor

| Japan

| Nov

| No

|

| arterolane maleate* + piperaquine phosphate (Synriam)

| Ranbaxy (Daiichi Sankyo)/ Medicines for Malaria Venture

| malaria

| Ca2+ ATPase inhibitor

| India

| Apr

| No

|

| Axitinib (Inlyta)

| Pfizer (from OSI Pharmaceuticals (now Astellas))

| advanced renal cell carcinoma

| VEGFR 1 ,2 & 3 inhibitor plus other targets

| US

| Mar

| No

|

| azilsartan* (Azilva)

| Takeda

| hypertension

| angiotensin II antagonist

| Japan

| May

| No

|

| bixalomer (Kiklin Capsules)

| Astellas Pharma (co-promoted by Sanwa Kagaku Kenkyusho and licensed from Amgen)

| hyperphosphatemia

| phosphate antagonist

| Japan

| Jun

| No

|

| bosutinib (Bosulif)

| Pfizer (from Wyeth)

| chronic myelogenous leukemia

| Src inhibitor and other targets

| US

| Novr

| No

|

| carfilzomib (Kyprolis)

| Onyx Pharmaceuticals

| multiple myeloma

| proteasome inhibitor

| US

| Jul

| No

|

| catridecacog (Novothirteen)

| Bristol-Myers Squibb/Novo Nordisk (orignally ZymoGenetics, via CSL Behring)

| Factor XIII deficiency

| Factor XIII stimulant

| Denmark

| Dec

| No

|

| enzalutamide (Xtandi)

| Medivation

| metastatic castration-resistant prostate cancer

| androgen receptor antagonist

| US

| Sep

| No

|

| gemigliptin (Zemiglo)

| LG Life Sciences

| type 2 diabetes

| DPP-IV inhibitor

| South Korea

| Dec

| No

|

| glucarpidase (Voraxaze)

| HPA Porton Down/BTG

| toxic plasma methotrexate concentrations

| serine carboxypeptid-ase inhibitor

| US

| Apr

| YES

|

| human umbilical cord blood-derived mesenchymal stem cells (Cartistem)

| Dong-A (licensed from Medipost)

| osteoarthritis

| cartilage regeneration

| South Korea

| Apr

| No

|

| iguratimod (Iremod)

| Simcere Pharmaceuticals

| rheumatoid arthitis

| Anti-inflammatory - anti-IL 2, 6, 8 and TNF

| China

| Feb

| No

|

| ingenol mebutate (Picato)

| Leo Pharma

| actinic keratosis

| protein kinase C delta stimulant

| US

| Mar

| YES

|

| ivacaftor (Kalydeco)

| Vertex Pharmaceuticals

| cystic fibrosis

| CF transmembrane conductance regulator agonist

| US

| Feb

| YES

|

| JE vaccine (Imojev)

| Sanofi (through Acambis)

| Japanese encephalitis prophylaxis

| Immuno-stimulant

| Australia

| Dec

| No

|

| linaclotide acetate (Linzess)

| Ironwood Pharmaceuticals/ Forest Laboratories

| chronic idiopathic constipation and constipation-predominant IBS

| guanylate cyclase stimulant

| US

| Dec

| No

|

| menACWY-TT vaccine (Nimenrix)

| GlaxoSmithKline

| meningococcal prophylaxis

| Immuno-stimulant

| UK

| Jul

| No

|

| mogamulizumb (Poteligeo)

| Kyowa Hakko Kirin/Onco Therapy Science

| T-cell lymphoma

| CC chemokine receptor 4 antagonist

| Japan

| May

| YES

|

| omacetaxine mepesuccinate (Synribo)

| Teva (licensed from ChemGenex)

| chronic myelogenous leukemia

| apoptosis stimulant

| US

| Nov

| No

|

| pasireotide (Signifor)

| Novartis

| Cushing's disease

| somatostatin receptor agonist

| UK

| Oct

| No

|

| peginesatide (Omontys)

| Takeda (licensed from Affymax)

| anemia in adult patients on dialysis

| erythropoiesis-stimulating agent

| US

| Apr

| No

|

| perampanel (Fycompa)

| Eisai

| epilepsy

| AMPA receptor antagonist

| UK

| Sep

| YES

|

| pertuzumab (Perjeta)

| Hoffmann-La Roche

| breast cancer

| EGFR-2 antagonist

| US

| Jul

| No

|

| pixantrone (Pixuvri)

| Cell Therapeutics

| non-Hodgkin's lymphoma

| DNA topoisomerase II inhibitor

| Denmark, Finland, Sweden, Austria

| Sep

| No

|

| ponatinib (Iclusig)

| Ariad

| chronic myeloid and acute lymphoblastic leukemia

| Bcr-Abl and other kinase targets

| US

| Dec

| No

|

| radotinib (Supect)

| Il-Yang

| chronic myelogenous leukemia

| Bcr-Abl inhibitor and other targets

| South Korea

| not known (approved in Jan)

| No

|

| raxibacumab (Abthrax)

| GlaxoSmithKline (through Human Genome Sciences, originated by Cambridge Antibody Technology (now AstraZeneca))

| anthrax prophylaxis

| Bacillus anthracis protective antigen inhibitor

| US

| Dec

| YES

|

| recombinant hepatitis E vaccine (Escherichia coli) (Hecolin)

| Xiamen Innovax Biotech

| hepatitis-E virus prophylaxis

| Immuno-stimulant

| China

| Dec

| YES

|

| regorafenib (Stivarga)

| Bayer Healthcare/ Onyx Pharmaceuticals

| metastatic colorectal cancer

| VEGFR inhibitor plus other kinase targets

| US

| Nov

| No

|

| tafamidis meglumine (Vyndaqel)

| Pfizer (through acquisition of FoldRx)

| transthyretin familial amyloid polyneuropathy (TTR-FAP)

| transthyretin stabilizer

| Ireland and Sweden

| Jun

| YES

|

| taliglucerase alfa (Elelyso)

| Pfizer (licensed from Protalix

| Gaucher's disease

| glucosylceramidase stimulant

| US

| Jun

| No

|

| teneligliptin (Tenelia)

| Mitsubishi Tanabe Pharma/Daiichi Sankyo (licensed by DS for joint marketing)

| type 2 diabetes

| dipeptidyl peptidase 4 (DPP IV) inhibitor

| Japan

| Sep

| No

|

| teriflunomide (Aubagio)

| Sanofi (through Genzyme)

| relapsing-remitting multiple sclerosis

| dihydroorotate dehydrogenase

| US

| Oct

| No

|

| tofacitinib (Xeljanz)

| Pfizer

| rheumatoid arthritis

| Janus kinase 1 and 3 inhibitor

| US

| Dec

| YES

|

| vismodegib (Erivedge)

| Hoffmann-La Roche (in collaboration with Curis)

| locally advanced or metastatic basal cell carcinoma

| hedgehog pathway inhibitor

| US

| Mar

| YES

|

| ziv-aflibercept (Zaltrap)

| Regeneron/ Sanofi

| metastatic colorectal cancer

| VEGF inhibitor

| US

| Sep

| No

|

Source: Scrip Intelligence in conjunction with Pipeline, Citeline 2013

AddendumSince this article was published, it has come to Scrip’s attention that the list ought also to include Stribild, as it contains the new active substance elvitegravir as one of its four ingredients (NB cobiscitat acts as a booster and has no direct anti-HIV effect).

| Elvitegravir + emtricitabine + cobicistat + tenofovir DF (Stribild) | Gilead Sciences | HIV/AIDS | HIV integrase inhibitor | US | August | no |

*Also, it should be noted that azilsartan is the active moiety of Takeda’s prodrug azilsartan medoxomil, which was first launched in the US in 2011 as Edarbi.

(9 May 2013)