SCRIP 100: Pharma slims down to retain healthy heart

This article was originally published in Scrip

Novartis now at number three, overtaking Merck & Co

There have been significant performances from emerging biopharmaceutical companies such as Vertex

Total pharmaceutical sales of the Scrip 100 league table members in 2011 came to $687 billion, with the leading 100 prescription pharmaceutical companies' total increasing by 7.8% over 2010's total figure of $637 billion, or $50 billion in absolute terms.

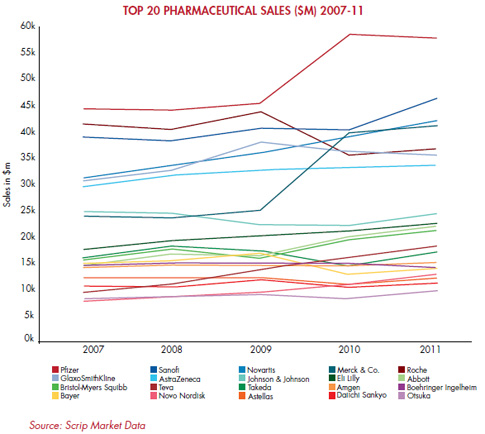

On top of the Scrip 100 table for 2011, with sales of almost $58 billion, is once again the US pharma giant Pfizer. The New York-based firm still commands a dominate position, with its 2011 total (from prescription pharmaceuticals) a clear $11 billion ahead of the second highest-placed pharma company in 2011, French firm Sanofi. These top two players had contrasting years, with Pfizer posting a year-on-year sales decline of 1.3%, whereas Sanofi (boosted by consolidating sales of Genzyme following the completion of the acquisition of the US biotech in April, 2011) ramped up its topline by 15.2% over its 2010 total.

See the full Scrip 100 league tables here

In the final quarter of 2011, Pfizer's long standing flagship product, the anti-dyslipidemia therapeutic Lipitor (atorvastatin) lost patent protection in its key US market and with the ensuing generic sales entry saw its global sales decline by $600 million in the final quarter of 2011 (a significant amount given generics were only available in the US for roughly half of that quarter). In total, sales of Lipitor declined by over 10% during 2011, versus its 2010 total.

However, it is not just the leading statin's sales declines that Pfizer has to contend with. Pfizer faces the problems of a maturing portfolio with an extensive array of high sales generating-drugs that are experiencing, or are soon to experience, generic sales erosion. In total, over $12 billion in sales are expected to be wiped from Pfizer's topline over the period 2011-17 which equates to over 20% of the company's total sales in 2011. Lipitor is responsible for over $7 billion of this expiry portfolio decline, with other significant declines expected to come from Celebrex (celecoxib), Geodon/Zeldox (ziprasidone) and Zyvox (linezolid). Such is the maturity of Pfizer's offering that Datamonitor has identified 40 key brands that are positioned within Pfizer's portfolio that are currently facing generic sales erosion, or will in the near future.

The third-placed pharma player in 2011, Switzerland's Novartis, like Sanofi, had a strong year during 2011, posting an increase in pharmaceutical sales of 7.9% over 2010 and jumping up one place in the league table, overtaking US firm Merck & Co, which was relegated to the fourth highest. Novartis gained an immediate uplift in pharma sales when it completed its acquisition of ophthalmology specialist Alcon in April 2011. However, the company's suite of innovative drugs such as the targeted therapy for chronic myeloid leukemia Gleevec/Glivec (imatinib) and its successful 2011 launch of MS drug Gilenya (fingolimod), along with the continued uptake of the cancer therapy Afinitor (everolimus) will position the company as the best performing of the pharma companies with sales in excess of $10 billion.

By 2017, Datamonitor expects Novartis (including sales from its generic business unit Sandoz) to be the biggest industry player, overtaking Sanofi and Pfizer in the process, with its topline prescription pharma total forecast to expand at a six year compound annual growth rate (CAGR) of 3.2%, with its topline sales expected to increase by $10 billion over a six year period.

The remainder of the companies within the group of $10 billion+ of pharmaceutical sales (of which there are 19) show little in the way of movement in the rankings (over 2010's performance), with half of the companies in the group maintaining their respective positions.

Domestic BRIC companies not quite there yet

In terms of the emerging markets, it is India that dominates with six companies inside the Scrip 100 list (the third highest total for an individual country). Surprisingly, Chinese pharmaceutical firms are absent from the top 100. In fact, the largest firm from the world's highest populated country was in 129th place, the China Pharmaceutical Group, with 2011 prescription pharma sales of just $315 million, although the Hong Kong-based firm did see its pharma sales increase by a significant 6.2% over the year prior.

With 27 companies each within the top 100, the US and Japan-headquartered companies equate to the highest proportion of the Scrip 100 total market size. In 2011, total prescription pharmaceuticals from US-headquartered firms totaled $266 billion, which was a 38.7% share of the Scrip 100 total. Japan-headquartered firms totaled a fraction of this with $93 billion, or a 13.5% share, with Western European companies accounting for 42% of the 2011 total. All combined, sales from companies headquartered in the established markets accounted for over 95% of the Scrip 100's total sales in 2011, which matched 2010's share.

Assuming that most of the Scrip 100 derive the majority of their sales from their respective hinterlands, then a logical correlation between the dominance of established market companies within the Scrip 100 and sales from the established markets is arrived at. Despite this a significant number of major pharma companies have managed to penetrate the emerging markets through a range of strategies, for example corporate M&A or through marketing partnerships.

Given that the established markets are suffering from a plethora of growth-resisting factors: healthcare reform, the global recession and increasingly cost-conscious and price sensitive governments and other payers, the rise in the rankings of companies headquartered in the emerging markets will be inevitable in future Scrip 100 league tables.

Cost-cutting returns results for 2011's underperformers

On top of the well-documented impact of generic sales erosion and Big Pharma's "innovation crisis", the backdrop of continued global economic uncertainty and increasingly difficult marketing conditions, particularly in the established markets has led pharma companies to look at ways to deliver margin growth in an attempt to appease their all-important shareholders.

Indeed, while the major pharmaceutical companies are in the midst of the patent cliff, no major pharmaceutical company will be immune in the coming years from major patent expiries (AstraZeneca, Bristol-Myers Squibb and Eli Lilly in particular have extremely high expiry burdens) and even over-achiever Novartis will see key, mega-blockbuster brands ravaged by the onslaught of cheaper copies of drugs (Gleevec, 2016 and Diovan (valsartan) 2012).

It is unsurprising then, that the list of pharma companies that have announced major cost-cutting initiatives over the past couple of years, be it outsourcing, major organizational restructuring and an increase in joint-ventures as a cost sharing activity, is long.

In November 2010, Roche announced the implementation of its Operational Excellence Program which the company estimated would save almost $5.0 billion over a two year period. A combination of R&D restructuring, site closures and job redundancies began during 2011 and have continued into 2012. Roche, for a while the golden child of the pharmaceutical world, did not enjoy a strong 2011, with sales of the company's key monoclonal antibody drug Avastin (bevacizumab) declining over 18% over the year prior after losing its breast cancer indication in the US. Furthermore, with an increasingly cost-conscious market, the development and acceptance of biosimilars gathering pace and Roche's portfolio of high-priced biologic therapies was faced with strong resistors to significant sales growth over the near term, prompting senior management to act.

Pfizer's demise has been referenced quite thoroughly so far, however, senior management's approach to dealing with the fall-out of the Lipitor expiry (among others) has evolved over recent years. Initially the company used its 2009 merger with Wyeth in order to implement large cost-saving initiatives, namely redundancies. Interestingly though, commencing in late 2011 and more so through 2012, Pfizer's cost-saving strategy has switched to that of a complete overhaul of its company structure, the vision being for two primary businesses with distinct cost structures and operating approaches – an innovative business and a value business.

CEO Ian Read envisioned the first as an R&D-based business that is capable of generating revenue and cash flow growth and a sustainable innovation engine (the R&D-driven prescription pharmaceutical business; primary care, specialty care, and oncology), with the second business operating as a value business capable of generating strong cash flow from already off-patent products (the established products business unit) in addition to a re-emergence of sales from over-the-counter drugs/consumer healthcare. In-line with this Pfizer has already completed a number of divestments (Capsugel, 2011, Nutrition, 2012) and is currently in the process of spinning out its animal health division. A similar approach is currently being implemented at Abbott Laboratories.

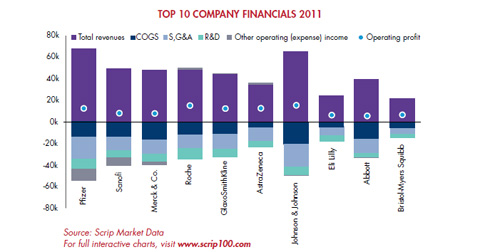

Significantly, when assessing the larger companies with below-par sales growth during 2011 and their operating profit growth over the same period, some stand-out cases are visible. The Scrip 100 financial data shows that the likes of AstraZeneca, Roche and Pfizer, which achieved a combined prescription pharmaceutical sales growth of less than $1 billion over 2010-11, saw a combined operating profit total growth of over $7 billion over the same time period.

Major pharma companies' ability to make these cuts and achieve profit growth through a period of topline stagnation has helped to sustain these company's market valuations. However in the long-term they'll have to show that their strategies to renew sales growth are going to pay off.

High climbers show similar traits

Away from the stuttering growth of the larger players, there are some success stories within the Scrip 100. Significant performances from emerging biopharmaceutical companies such as Vertex (the fastest growing year-on-year rate in the Scrip 100 with an annual growth rate in excess of 800%) which ranked the Massachusetts-based company as the 64th biggest in 2011 (in 2010 the company was unranked). In 2011 Vertex launched its hepatitis C drug Incivek (telapravir) along with development partner Johnson & Johnson and furthermore in 2012 launched its orphan drug Kalydeco (ivacaftor), which will help maintain the company's position in the top 100. Alexion, a company that markets the monoclonal antibody Soliris (eculizumab) for the orphan disease of paroxysmal nocturnal hemoglobinuria saw strong growth and it too entered the Scrip 100 during 2011, advancing 19 places from its 2010 position to be positioned as the industry's 88th biggest player.

However, it is not just the emerging biopharmas that had strong years in 2011; companies with relatively large sales scale such as US firm Celgene, which saw total pharma sales increase by 34.0% during 2011, advancing the company up six places in the table to 28th position. Celgene, which is highly reliant on the multiple myeloma and myelodysplastic syndrome treatment Revlimid (lenalidomide) is an almost 100% oncology–pure play company and is expected to continue to go from strength to strength over the period 2011-17 given that Revlimid (which provided over 70% of the company's total pharma sales in 2011) is patent protected until 2018.

A similarly focused company, Gilead Sciences, which is the global leader in HIV fixed-dose combination therapies had another strong year during 2011, with total pharma sales advancing by 9.6%, maintaining the company at the 24th spot in the league table, although ever edging the company toward the dizzy heights of the $10 billion+ group of companies. Shire saw significant growth during 2011, through its niche disorder focus (in addition to gains in its ADHD blockbuster franchise), seeing its pharma sales total increase by 26.3%, raising the company up the Scrip 100 table by five places to number 33.

Cost saving initiatives to fuel a second wave of M&A?

While these fast-growing, focused companies can enjoy their current rise up the Scrip 100 league table, such growth rates and streamlined business models are, naturally, an attractive proposition for the larger firms that are suffering from a stagnating pharma sales performances. Also, given the strong fiscal performances of select companies during a period of dire market conditions through major restructuring and cost saving initiatives, which is ultimately feeding into the company's operating profit and potentially into the major company's cash deposits, small to medium-sized companies will be looking over their shoulders at predatory would-be buyers. Indeed, 2012 has seen a number of big pharma acquisitions of small, focused players such as Bristol-Myers Squibb's acquisition of diabetes specialist Amylin and GlaxoSmithKline's purchase of Human Genome Sciences.

Moreover, given the current trend of major pharmaceutical players restructuring their business models into more manageable/focused structures with the primary goal of being able to focus on innovation and thereby addressing the lack of R&D productivity, a second consequence could be a more simplified consolidation of high growth focused pharma companies, with many of the larger members of the Scrip 100 tempted to dissolve small, fast growing pure-play companies into their newly created divisions.