Market Insight – Merck & Co/Schering-Plough cuts a finer figure

This article was originally published in Scrip

Merck & Co has chosen a formidable merger partner in Schering-Plough in a deal that promises an increased focus on neurology and infectious diseases, a shift towards specialist care in cardiovascular diseases as well as an impressive late-stage pipeline, writes Dr Nick Karachalias

As a standalone company, Merck & Co would face a tough future of declining sales. Datamonitor forecasts revenues from the company's prescription pharmaceutical portfolio – including 50% of Zetia (ezetimibe)/Vytorin (ezetimibe plus simvastatin) sales – to decline at a 2008-13 compound annual growth rate (CAGR) of -0.3%. Generic competition against major patent-expired products is the key factor behind this contraction. Four brands – Singulair (montelukast), Cozaar/Hyzaar (losartan), Fosamax (alendronate) and Zocor (simvastatin) – are all expected to suffer particularly intense generic competition out to 2013.

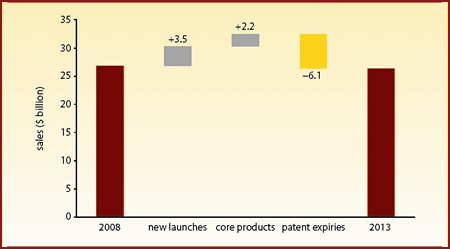

Figure 1 highlights the scale of the patent expiry threat facing Merck & Co. In 2008-13, new launch products, including Isentress (raltegravir) and Janumet (sitagliptin/metformin), will boost annual sales by $3.5 billion and core marketed products will generate a further $2.2 billion annual increase. However, a wall of expiring products will wipe $6.1 billion from annual sales, leaving Merck's 2013 annual sales standing $435 million below 2008 levels.

| Figure 1: Merck & Co product life cycle stage analysis, 2008-13 |

| |

| Source: company-reported historical sales data; Datamonitor forecasts |

In terms of resuscitating its sales growth prospects, Merck has selected an attractive merger target in Schering-Plough. As a standalone company, Schering-Plough would expect to see its sales grow at a CAGR of 4.5%, the fastest growth rate to 2013 for any US big pharma player.

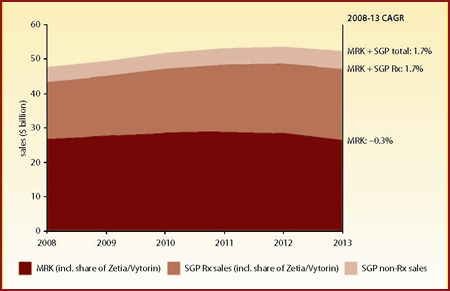

Figure 2 depicts the sales growth profile for Merck alone, Merck plus Schering-Plough's prescription drug portfolio, and Merck plus all of Schering-Plough (prescription pharmaceuticals, animal and consumer health, etc). The addition of Schering-Plough is expected to lift Merck's 2008-13 CAGR from -0.3% to +1.7%.

| Figure 2: Merck & Co and Schering-Plough total sales ($ billion), 2008-13 |

| |

| Source: company-reported historical sales data; Datamonitor forecasts |

In terms of 2008 revenues, Merck's three main areas of focus are cardiovascular, respiratory and infectious diseases. That 29% of the $12 billion portfolio that will be exposed to generic competition by 2015 comes from cardiovascular, 36% from respiratory and 7% from infectious diseases, underscores Merck's need for a transformational deal.

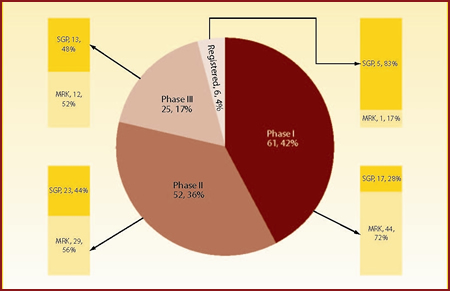

shift towards late-stage projects

Just over half of Merck's total 86 candidates (excluding preclinical assets) are in Phase I, with progressively fewer compounds further down the pipeline. By contrast, Schering-Plough's pipeline is biased towards the later stages of development. It is of note that despite having just two thirds of Merck's number of molecules in development (58 versus 86), Schering-Plough's pipeline shows more registered candidates (five versus one), more molecules in Phase III trials (13 versus 12) and almost an equal number of candidates in Phase II trials (23 versus 29).

As expected, the post-merger company will have a stronger focus on later stage projects compared with Merck's original pipeline, with the difference becoming more prominent in registered and Phase III candidates. Figure 3 presents the combined pipelines split by phase of development and originating company.

| Figure 3: Merged company's pipeline distributed by phase of development and originator |

| |

| Source: Thomson Pharma, Datamonitor |

neurology and infectious diseases

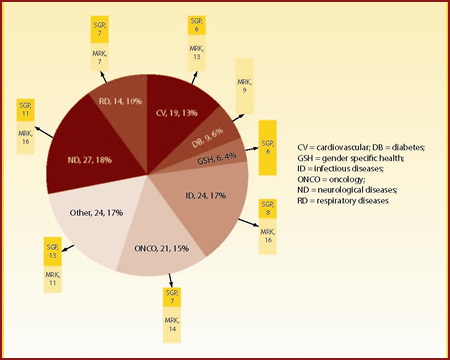

Merck's pipeline exhibits a relatively even split among its core disease areas. Even so, a relatively high number of candidates are in development for oncology, infectious diseases, cardiovascular diseases and "other" indications, including immunology and inflammation.

Merck and Schering-Plough are active in the same disease areas with two exceptions: diabetes (only Merck is active) and gender specific health (only Schering-Plough has notable candidates). Schering-Plough's research pipeline exhibits an increased focus on products in development for oncology and neurological diseases (including psychiatric indications).

The pipeline resulting from the two merged companies is presented in Figure 4. As expected, the four most prominent therapy areas are neurological diseases (27 agents in development), infectious diseases (24), "other" indications (24) and oncology (21).

| Figure 4: Merged company's pipeline distributed by disease area and originator |

| |

| Source: Thomson Pharma, Datamonitor |

complementarities and overlap

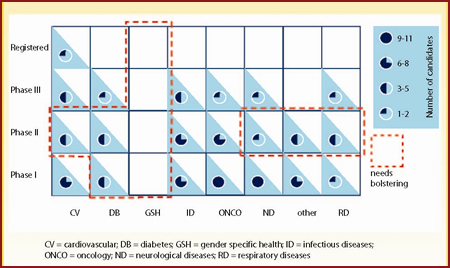

By combining the two analyses, we can assess the status of each company's pipeline and identify areas that need bolstering. Figure 5 is a matrix representing the number of candidates that Merck has for each therapy area and by phase of development. It immediately becomes apparent that while Merck has a strong early phase pipeline, there are other areas that need to be strengthened.

| Figure 5: Overall assessment of Merck's pipeline by phase of development and disease area |

| |

| Source: Thomson Pharma, Datamonitor |

Of note is the lack of candidates in gender specific health and the limited number of products in Phase II development for cardiovascular diseases, diabetes, neurological diseases, "other" indications and respiratory diseases. In addition, Merck is distinctly low on registered molecules; only one cardiovascular candidate is in registration.

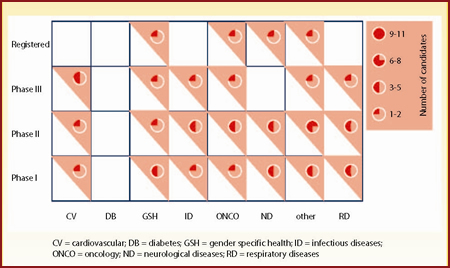

| Figure 6: Overall assessment of Schering-Plough's pipeline by phase of development and disease area |

| |

| Source: Thomson Pharma, Datamonitor |

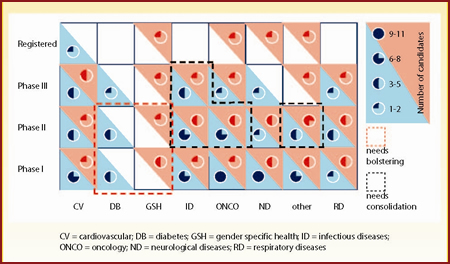

Figure 6 is a matrix for Schering-Plough's portfolio and Figure 7 a matrix for the combined pipelines. Post-merger, Merck will have the opportunity to acquire Schering-Plough's gender specific health portfolio, comprising seven agents spanning all stages of development. In addition, Merck's neurological and respiratory diseases portfolios will be significantly strengthened. On the other hand, Merck's diabetes portfolio will not be augmented by the acquisition, leaving the early developmental phases relatively sparsely populated.

| Figure 7: Overall assessment of Merck and Schering-Plough's combined pipelines by phase of development and disease area |

| |

| Source: Thomson Pharma, Datamonitor |

Finally, the merger might lead to the overpopulation of certain developmental phases where both companies have candidates. Potentially problematic areas are the infectious diseases portfolio across Phase II and Phase III, the oncology portfolio in Phase II and the "other" indications portfolio in Phase II. However, the latter might pose less of an issue since there are a plethora of indications to absorb these developmental candidates.

immunology and inflammation

Merck stands to benefit significantly in the immunology and inflammation arena, with the Schering-Plough acquisition strengthening a failing portfolio.

Schering-Plough has exclusive worldwide marketing rights to Remicade (infliximab), a monoclonal antibody targeting tumour necrosis factor (TNF), in all markets outside the US, Japan and other parts of the Far East. Centocor (Johnson & Johnson) brokered this deal in 1998 and, as of a renegotiation in December 2007, the agreement now extends beyond 2014. The original 1998 deal also includes the Remicade "follow-on" molecule Simponi (golimumab), which targets the same cytokine with improved administration and structural characteristics. In 2005, Schering-Plough exercised its rights to develop and market Simponi, which is expected to launch during 2009 and to reach blockbuster status.

However, the continuing market success of both Remicade and Simponi is by no means guaranteed. As the only intravenous anti-TNF on the market, Remicade will always have a niche of patients from all indications who do not want to, or cannot self inject. But, on the whole, most patients prefer the ease and freedom of a self-administering subcutaneous injection, which underpins the success of Remicade's key competitors Enbrel (etanercept) and Humira (adalimumab).

Simponi will be the fifth anti-TNF brand on the market, joining a crowded and heavily competitive area, with only a variable dosing method (intravenous or subcutaneous injection) to differentiate itself. In fact, the dual administration strategy is something that physicians interviewed by Datamonitor have expressed confusion about.

Remicade sales are expected to level off and the launch of an intravenous formulation of Simponi will result in a switching of patients to the newer molecule – to the detriment of Remicade. What looks like two major blockbusters on paper may turn out to be one blockbuster at the expense of the other when market dynamics are taken into account.

gender specific health

Merck has enjoyed a leading position in the osteoporosis market thanks to its blockbuster oral bisphosphonate Fosamax, which in 2007 generated sales of $3.05 billion. In anticipation of Fosamax's patent expiry in 2008, Merck put in place an effective life cycle management strategy that included the launch of Fosamax Plus D. However, as expected, the patent expiry has compromised Merck's position as a market leader, cutting the product's sales to $1.55 billion in 2008.

The two pipeline osteoporosis drugs (MK-0822 and MK-5442) that Merck is developing are unlikely to make up for lost revenues from the Fosamax franchise. Odanacatib (MK-0822) harbours greater potential as it is the most advanced cathepsin K inhibitor, and is expected to reach the FDA by 2012, ahead of competitor products. In addition, early clinical results have shown that odanacatib is safe and well tolerated.

If these findings are confirmed in Phase III trials, Merck will be able to exploit its leading market position and continue its successful osteoporosis franchise. By contrast, MK-5442 is expected to launch in a competitive section of the market, currently dominated by Lilly's Forteo (teriparatide), and target a niche population of severe osteoporosis sufferers.

The merger with Schering-Plough will not broaden Merck's osteoporosis portfolio, but it will bring a highly related range of women's health products. In particular, following the acquisition of Organon, Schering-Plough has developed a strong market position in the infertility and contraception markets with not only numerous marketed products (Puregon/Follistim, Pregnyl, Ganirelix, NuvaRing) but also a solid pipeline with four products in Phase III development. In addition, Schering-Plough's considerable dedicated sales force is expected to benefit the promotion of Merck's HPV vaccine Gardasil.

respiratory portfolios strengthened

Schering-Plough has a firm position in the respiratory market, historically focusing on allergic rhinitis, with Nasonex (mometasone) and Clarinex (desloratadine) as its major brands. Merck's only, but highly successful respiratory product is Singulair, an oral non-steroidal anti-inflammatory for the treatment of allergic rhinitis and asthma; it will complement Schering-Plough's franchise nicely. The companies have already collaborated in the allergy market by developing a fixed-dose combination of Singulair and Claritin (loratadine), an oral antihistamine and Clarinex's predecessor. However, the compound was rejected by the FDA in April 2008, probably linked to a lack of additional clinical benefit over currently available products.

Schering-Plough is also collaborating with Novartis to develop Asmanex (mometasone) as part of two fixed-dose ICS/long-acting beta2-agonist (LABA) products. These fixed-dose inhalers are expected to achieve combined sales of $3.2 billion in 2017. The latter products are unlikely to compete with the Singulair/ICS fixed-dose combination product that Merck is thought to be developing, as they would target slightly different subsets of the patient population.

Both Schering-Plough and Merck are also developing novel anti-inflammatories for the treatment of COPD and severe asthma, targeting CXC chemokine receptor 2 (CXCR2) and 5-lipooxygenase, respectively. Given the significant unmet need and long history of development failures in these areas as well as possibly synergistic actions or different target populations, the merger is not expected to impact either compound's progress.

early-stage neurologicals

In the CNS disease area, the merger will not have a significant impact on Merck's outlook over the near to mid term. Neither company has a significant presence in the CNS market or a blockbuster CNS brand.

The merger will not offer Merck any synergies in its current core CNS indication of acute migraine therapy. Merck markets Maxalt (rizatriptan) in this indication, which it already planned to supplement with the novel product telcagepant (currently in Phase III).

While Schering-Plough does posses several CNS drugs in its late-stage pipeline – Saphris (asenapine, for schizophrenia), esmirtazipine (for insomnia) and the anaesthetic Sugammadex – these will be entering mature and highly competitive markets and are not expected to generate blockbuster revenues. While the combined company will remain underweight in terms of CNS revenues compared with its peers over the near to mid term, both companies have invested in CNS-focused R&D over the past few years. Thus a plethora of promising early-stage products provides the potential for significant gains in this therapy area over the longer term.

oncology: questionable importance?

Oncology has historically been a minor source of revenue for Merck. The company markets a single anticancer drug, Zolinza (vorinostat), which was approved and recently launched for the niche indication of cutaneous T-cell lymphoma. It achieved estimated global sales of just $17 million in 2008. Merck also markets Emend (aprepitant), indicated for chemotherapy-induced nausea and vomiting, although this has only achieved modest market penetration in a highly genericised market, with sales of $264 million in 2008.

Merck's acquisition of Schering-Plough will immediately increase the company's footprint in the oncology market, providing three additional marketed cancer brands. The most lucrative of these is Temodar (temozolomide), which is firmly established as the standard-of-care for primary brain cancer and achieved global sales of $1 billion in 2008.

Deforolimus, which is in Phase III development for the treatment of sarcoma, is Merck's only late-phase oncology pipeline drug. The acquisition will give Merck one extra late-phase pipeline oncology agent, PEG-Intron (pegylated interferon-alfa-2b), which is in pre-registration in the US for melanoma. However, this drug is not expected to achieve notable market penetration given the toxicity shown in clinical trials, low use of interferon alfa-2b in melanoma and likely competition from biosimilar versions of interferon alfa-2b. The acquisition will also add a further three Phase II compounds: robatumumab, a CDK inhibitor and a CHK-1 inhibitor.

cardiovascular: specialist care

Although Merck and Schering-Plough's joint venture cholesterol franchise is a considerable asset (generating sales of $4.6 billion in 2008), it has recently suffered from major setbacks. Its growth in the US has been reversed by the well publicised controversies surrounding the ENHANCE and SEAS studies. With the medical community focusing on intensive statin therapy for the treatment of dyslipidaemia, the possibility that prescriptions for Zetia and Vytorin in the US will fall to the equivalent levels noted in Europe looms large.

In addition, Merck's cholesterol pipeline has been substantially weakened by the non-approval in the US of Tredaptive (niacin and laropiprant, formerly Cordaptive; approved in Europe but not yet launched due to manufacturing problems). This product could be approved in the US around 2012, after completion of the ongoing outcomes study (HPS2-THRIVE Study) that is being requested by the FDA. The impact of this delay or non-approval is particularly meaningful given Merck's dependence on the molecule in its planned combination products, MK-0524B (Tredaptive and generic Zocor) and MK-0524C (Tredaptive and generic Lipitor).

However, Schering-Plough has some promising late-stage cardiovascular compounds in the form of its thrombin receptor antagonist SCH-530348. The product has been fast-tracked by the FDA, is nearing completion of Phase III trials and is expected to be submitted to the FDA in 2010 or 2011. In Phase II trials, SCH 530348 showed a trend toward fewer ischaemic events without increasing bleeding when added to standard antiplatelet therapy with aspirin and clopidogrel in patients undergoing PCI (percutaneous coronary intervention). If Phase III trials confirm that the drug does actually reduce ischaemic events without increasing bleeding, it would be a surefire winner.

On the other hand, Merck's late-stage pipeline relies heavily on further combinations of Tredaptive and anacetrapib, a CETP inhibitor in development in a class tainted by the safety concerns surrounding Pfizer's late-stage failure, torcetrapib.

Even if Schering-Plough's late-stage pipeline fulfils its commercial potential, it is unlikely that it will be able to cover the gap left by the soon to be defunct hypertension franchise and diminishing sales of Zetia and Vytorin. Hence Merck's original strong position in the cardiovascular arena will be diluted after the deal. In addition, the resulting company is expected to change its focus in the cardiovascular arena from primary care indications to indications mainly covered by specialists.

infectious diseases

Vaccines play a crucial role in Merck's overall pharmaceutical revenues, with the share of such products in Merck's global pharmaceutical sales increasing from 6.2% in 2004 to 21.3% in 2008. While the failure or discontinuation of several pipeline candidates has thinned Merck's vaccine pipeline considerably, it will be strengthened by Schering-Plough's Nobilon unit, a Dutch vaccine development subsidiary spun out of Organon in 2003.

In HIV, Merck has one marketed antiretroviral and a strong pipeline which will make it a fierce competitor in the future. The company launched Isentress, a first-in-class integrase inhibitor, in 2007 and has an active early-stage pipeline. Although Schering-Plough has no marketed antiretrovirals, the company has a CCR5 inhibitor (vicriviroc) in Phase III development.

Isentress is already proving a commercial success with worldwide sales of $361 million in 2008, forecast to grow to $1.5 billion by 2013. Vicriviroc's outlook, however, is not nearly as bright. Belonging to the same class as Pfizer's commercial flop Selzentri/Celsentri (maraviroc), it suffers from an efficacy limited to a subset of patients. Yet if vicriviroc is successfully approved, there is an attractive opportunity for Merck/Schering-Plough to trial and market Isentress and vicriviroc use in combination, strengthening the combined entity's presence in the HIV market.

In the hepatitis C virus (HCV) arena the situation is somewhat reversed. In this commercially very attractive area, Merck currently has no marketed HCV products, but has a HCV protease inhibitor (MK-7009) in Phase II development. Schering-Plough, on the other hand, is a well established leader in the HCV market, with marketed pegylated interferon (Peg Intron) and ribavirin (Rebetol) therapies achieving combined sales of $1.2 billion in 2008. The developmental protease inhibitor boceprevir in Phase III and its follow-up compound SCH900518 in Phase II are among the most eagerly anticipated new HCV drugs with large sales potential. The new combined entity will therefore probably prioritise its research efforts in favour of either MK-7009 or SCH-900518 as boceprevir's follow-up protease inhibitor.

In conclusion, the upcoming merger will create a number of opportunities for Merck. Datamonitor forecasts that it will succeed in returning Merck to positive sales growth. This will be partly dependent on management delivering on its promise of an additional $3.5 billion of annual cost savings beyond 2011.

Schering-Plough's immunology and inflammation franchise is expected to make an important contribution to the new company. However, for this to materialise the issues surrounding Schering-Plough's partnership with Johnson & Johnson must be successfully resolved. In addition, the deal will allow Merck to consolidate 100% of the cholesterol joint venture sales, and Schering-Plough's respiratory franchise will integrate with Merck's business in this category. Other synergies will also be realised in women's health and vaccines portfolios.

Dr Nick Karachalias is Datamonitor's cardiovascular and diabetes lead analyst. Email: [email protected].